Invalid Will: 4 Reasons That Can Lead To The Invalidation Of Your Will

Crafting your Last Will and Testament is one of those pivotal adulting moments—it’s your chance to make clear decisions ...

Crafting your Last Will and Testament is one of those pivotal adulting moments—it’s your chance to make clear decisions ...

Think of a No Contest Clause as a peacekeeper among your beneficiaries. It’s there to deter anyone from stirring up lega...

Ever think about what would happen to your assets when you are no longer here on earth? Who would get what? Or will your...

Fortunately, the year is not over yet. We still have three months to go. And this presents a unique opportunity to revie...

Have you heard of the benevolent fund provided by Saccos? Before we get into what it is and how it benefits you, let’s r...

Did you know there is good debt and bad debt? The truth is that not all debt is created equal. Some credit can be good a...

Have you ever scrolled through social media and felt an irresistible urge to buy that trendy new gadget? Or maybe that d...

Have you ever wondered how to tap into the potential of the Kenyan stock market but felt overwhelmed by the process? Equ...

You finally landed your dream job after college? Or your big-awaited raise has finally hit. Now, it’s time to paint the ...

As you start your investment journey, it’s important to have a grasp of the financial market. From how they work to what...

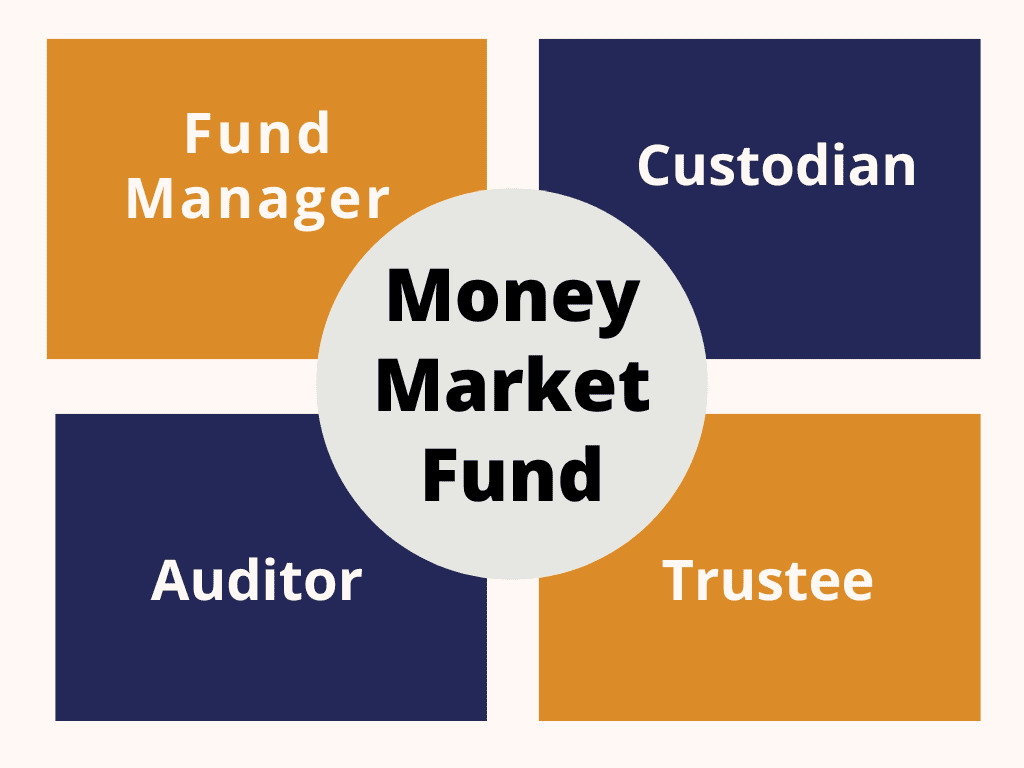

Here’s a question I’ve received lately, “Is my money safe in a money market fund (MMF)?” This was after one of the money...

It’s in our nature as humans to follow the crowd. Whether it’s eating at a crowded restaurant even if the food is overhy...