General Ledger (GL): What Is It and Why It’s Important

You’ve heard the term “general ledger” thrown around in business circles, but what exactly is it? And why is it importan...

You’ve heard the term “general ledger” thrown around in business circles, but what exactly is it? And why is it importan...

Are you the type of business owner who thinks of paying or rewarding yourself when your business finally starts turning ...

Does business banking vs commercial banking sound the same to you? Is that a ‘yes’ you are about to say? While the two m...

If you are wondering how to pay yourself as a business owner, welcome to the club. This is a question a lot of business ...

Do you know how to read a cash flow statement for your small business? Unfortunately, many small business owners focus o...

Here’s a question for you, ‘how many bank accounts do you need for your business?’ I have spent the better part of my c...

DISCLOSURE: THIS ARTICLE/WEBSITE USES AFFILIATE LINKS, WHICH MAY EARN A COMMISSION AT NO ADDITIONAL COST TO YOU. THIS IN...

DISCLOSURE: THIS ARTICLE/WEBSITE USES AFFILIATE LINKS, WHICH MAY EARN A COMMISSION AT NO ADDITIONAL COST TO YOU. THIS IN...

What bank transfer methods do you use for payment processing in your business? As a business owner, it’s important to un...

Disclosure: This article/website uses affiliate links, which may earn a commission at no additional cost to you. This in...

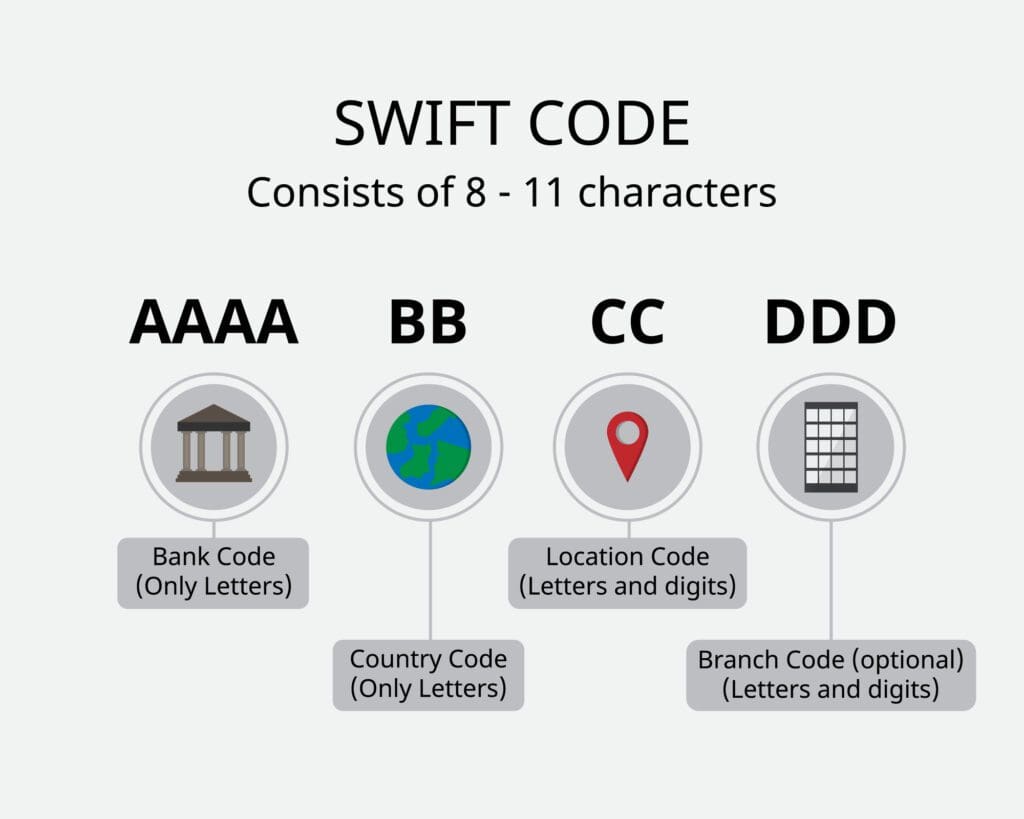

While I talked about the common mistakes to avoid when using SWIFT codes in this last article, it was only in passing. T...

How often do you waste your time chasing payments from delinquent client accounts? Are you getting ulcers just thinking ...