Invalid Will: 4 Reasons That Can Lead To The Invalidation Of Your Will

Crafting your Last Will and Testament is one of those pivotal adulting moments—it’s your chance to make clear decisions about the future of your estate. But what if, after all that careful thought, your will isn't considered legally valid? It’s more common than you might think.

YOUR PERSONAL FINANCES

5 Key Items Domestic Package Covers in Kenya

Home insurance or domestic package is always among the top insurance policies I recommend one to inc

Retirement Lessons From the F.I.R.E. Movement

Speaking of retirement planning, have you heard of the F.I.R.E. movement? That’s an acronym for Fi

Money and Emotions: Are Emotions Affecting Your Financial Decisions

Sometimes, money and emotions go hand-in-hand. Therefore, the better you are at managing your emotio

How to Create a Payday Routine in 4 Easy Steps

Do you have a payday routine? You know, a set of tasks or activities you indulge in before or when y

Business, Side Hustles and Money

Helping you to grow your side hustle and small business business

-

General Ledger (GL): What Is It and Why It’s Important

You’ve heard the term “general ledger” thrown around in business circles, but what exactly is it? And why is it important for you to understand how it works?

-

Business Banking vs Commercial Banking: What They Are and How to Choose the Best Option for Your Small Business

Does business banking vs commercial banking sound the same to you? Is that a ‘yes’ you are about to say? While the two might seem similar, they are actually quite different. From the target market to the services and products

-

Profit First Method: What It Is And How To Use It For Your Small Business

Are you the type of business owner who thinks of paying or rewarding yourself when your business finally starts turning a profit? Unfortunately, you are not alone.

Book reviews

Get Your Next Reading Inspiration

-

Slave, Interpreter & Commissioner General: An Authorized Biography of Edgar Manasseh by Richard Oduor Oduku

The authorised biography of Edgar Manasseh, Slave, Interpreter & Commissioner-General takes us through 200+ years of family’s history; right from Edgar’s great-grandfather, a slave, to his grandfather and father, who worked as civil servants in Kenya to Edgar’s rise as

-

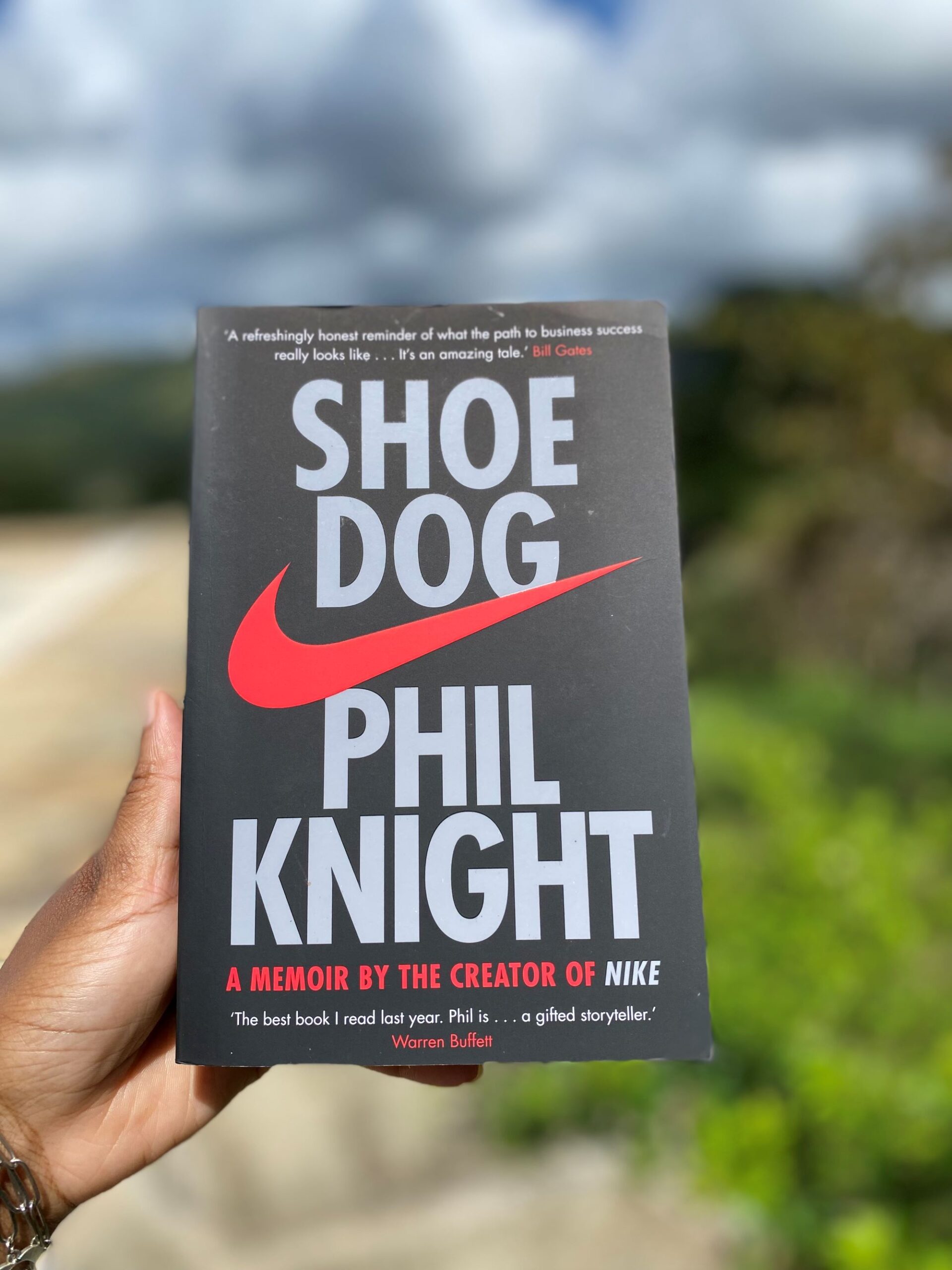

Shoe Dog by Phil Knight

The founding story of Nike, originally known as Blue Ribbon Sports, is not as rosy as its $46B revenue line item (for 2022), would lead you to believe. While they had the demand, supply was quite an issue. The company

EPC BUDGET PLANNER

EPC BUDGET PLANNER BOOK

There is never a wrong time to start planning your finances. And this planner is the ultimate budgeting planner you deserve to get started. What do you get?

✅Net worth tracker to see your financial position

✅ Monthly review system for analyzing your goals

✅And our personal favourite feature, bill organizers, aka pockets for your receipts

✅ Designed by a certified financial analyst & educator

Money conversations made fun!

My Top 5 Episodes

The Road to Financial Independence

#16 Top 5 Money Lessons From The Women in My Life

#15 Money, Women and Myths: Getting You Confident at Money Management & Investing

#14 Money and Emotions: Are Emotions Affecting Your Financial Decisions?

#13 Quick Start Emergency Fund: Step 1 to Financial Success

financial planning tools

Budgeting and other financial tools to help you stay on top of your finances