How to Create an Invoice: Quick Guide for Freelancers & Consultants

Whether you are a freelancer, consultant, or own a small business, one of the key things you must know is how to create an invoice. An invoice is a document you use to request payments from clients for the service/s you provided.

However, not everyone uses an invoice to request payment for work delivered.

For example, how do you request payment after delivering to your clients? Are you operating under a gentlemen’s agreement system where clients just send or hand you cash when the work is done? Or do you send them a document requesting payment?

And if it’s the latter, how professional is the document?

I have sat on the other side of the table, processing invoice payments for companies and individuals. One thing that stood out, especially when working with individual freelancers and consultants, is how the invoices had errors, lacked important information, or were unprofessional.

So, in this article, I will be taking you through all the important details you need to know about invoicing. From the definition of an invoice to the key information you must include and how to create an invoice that communicates your professionalism.

Let’s dive right in!

What is an Invoice

An invoice is a commercial document issued by a seller to a buyer with details about the specific transaction. This includes itemized line items of services rendered or goods sold, quantities, agreed pay, and relevant payment terms.

In simpler terms, an invoice is a document you, as a seller, send to your clients, the buyers, showing what you have sold them, the amount they owe you, how to get paid, and other payment terms.

Advantages of Using Invoices

Let’s start with why you must begin using invoices to request payments.

Receiving Your Payments on Time

While there are several reasons for late payments, not sending your invoice on time will definitely lead to late payments. In addition, sending an invoice with errors or one lacking the important details will also cause a delay in your payments. This will ultimately affect your cash flow.

Being Clear on Payment Terms

An invoice lets you be specific and clear about your payment terms. This includes the due date, late payment fee, and how you want to be paid, e.g., bank account details.

Easier Tax Filing

Invoices are excellent for creating a paper trail. In the event there are questions from the buyer or even the tax authority about particular payments, you can always go back to the invoice to confirm the details.

Protecting Yourself During Lawsuits

Imagine if a client delayed your payment or refused to pay you altogether even after delivering your end of the deal. Now, you are considering going to court to seek legal redress.

Although there are several documents you need to provide as part of your proof, an invoice is one of them. This can include the fact that it is error-free and you sent your invoice on time.

How to Create an Invoice

It might look overwhelming to create an invoice. And it can be if you do not know what you are doing. But it doesn’t have to be hectic.

So, here is a step-by-step guide about how to create an invoice like a pro;

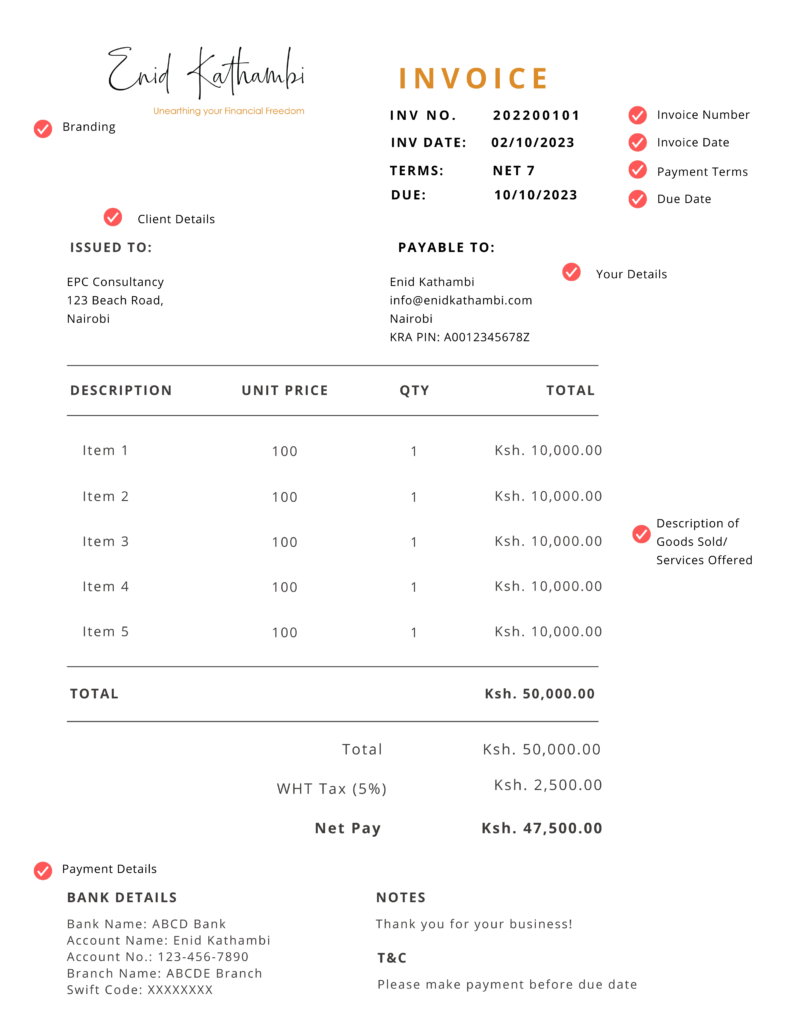

What to Include

There is no standard invoice. Because of this, invoices will vary between sellers and specific government regulations. Having said that, there are key items that every invoice must have. These are the key items that you must include in your invoice.

- Invoice date – this indicates the day a seller records the transaction and bills the buyer. In addition, the invoice date is a guide for the due date.

- Invoice number – every invoice should have an invoice number, each different from the other. For starters, it helps you keep your work organized. Second, it creates a paper trail, making accounting and tracking of invoices by you and your client much easier.

- Your contact details – from your name or name of your business to your mobile number, email address, and address. These can also be very useful in case of questions the buyer needs to reach you.

- Client’s contact details – you also need to include your buyer’s contact details.

- Description of goods and services and total amount – break it down into line items to show different services or goods sold, your rate for each, hours worked, quantities, any applied discounts, applicable tax, and total amount. Show currency as well. If you bill clients in different currencies, this will be a great guide, especially if you bill one client in other currencies.

- Payment terms – this section allows you to define important terms clearly. That includes the due date (on receipt, Net 7, 15, or 30 days), down payment terms, late payment fee charges, and refund conditions.

- Payment options – this guides the buyer about where to send your money. The more payment options you have, the more room for the client to choose one that works better for them. However, if you have a preferred method, you can use just that. Some common payment options include bank account details, mobile pay, and online accounts, e.g., Paypal, Payoneer, etc.

In addition to the above key items, it helps to have the below additional details in your invoice;

- Tax pin – for tax purposes, e.g., WHT. You want to reduce the chances of the buyer calling you constantly or returning your invoice due to the need for more important information.

- Branding – remember that first impressions matter. Branding your invoice with the brand logo, colors, and fonts will help create a good impression. Plus, it makes you look very professional.

- Signature & business stamp or seal

Where to Get Free Invoice Templates

Fortunately, there are invoice templates that save you from creating an invoice from scratch. You do not have to invest heavily in invoice-generating software, especially if you are trying to lower your costs.

Here are the most common free resources for creating invoices:

- Google Docs & Spreadsheet – both options have templates to choose from. Still, the level of customization is quite limited. I also recommend converting the final document into a PDF before sending it.

- Microsoft Excel & Word – Microsoft also has numerous templates you can use. Like Google Docs & Spreadsheet, you have limited customization options. Also, remember to convert the final document into PDF before sending it.

- Canva – the free pricing plan has numerous templates, including invoice templates.

Although these options save you money, they are very manual. This makes it tedious if you have many clients, especially if you want to order your invoice numbers chronologically. For instance, you’d have to input invoice numbers manually. This calls for great memory or flipping through endless documents to confirm the last invoice number.

Automate With Invoicing Software Tools

You can save yourself from all the above tedious work and have an added layer of trail audit with invoicing software. This can be accounting tools, like Zoho Books and QuickBooks, or invoice-generating software options.

I’d recommend settling for accounting software because of other added benefits. These include;

- No dealing with physical invoices

- Customizing with your brand details – adding colors and logo, which are applied automatically in each document you create

- Can create and send estimates

- Transforms estimates into invoices automatically

- Numbers the invoices automatically for you

- Track working hours – If you charge hourly, it can track the hours and automatically add these to an invoice for you

- You can set the system to send automatic reminders for overdue invoices

- It also tracks your income and expenses

- Collaborating with others in your team

- Automatically generates your financials (income statement) for easier tax filing

- Cloud management – you can access your accounting information from anywhere

- Some have apps where you can update transactions from your phone, e.g., capturing images for receipts

- Linking to a bank to accept payments

- Some have apps that you can use on the go

Unfortunately, these options are not free. Ensure you shop around and look for software within your budget. You can always upgrade to a better system as your business grows.

Related read: 4 Proven Advantages of Online Accounting Software for SMEs

Best Practices to Get Paid

Now that you know how to create an invoice, how do you increase your chances of getting paid on time?

- Review before sending – error-free invoices reduce late payment

- Send your invoices on time – this should be immediately after finishing the work

- Asking for a downpayment – especially if you need money to start the project, are dealing with a client who has been problematic before, or have not worked with them before

- Spare time every end of the week or month to review your work for the period, confirm you have invoiced everyone, and send payment reminders or invoices for jobs you have not invoiced yet

- Set reminders – to follow up on due and unpaid invoices. If you are using accounting software, you can automate this process.

In Conclusion

Whether you are being paid in cash, wire transfer, or mobile money, it is always good to use invoices. With the above tips on how to create an invoice, you can easily create a professional invoice for your next job. Ensure you include all the relevant details, including invoice date, number, contact information, services or goods sold, amounts, payment terms, and how you want to be paid.

FAQ

What’s The Difference Between an Invoice and a Receipt?

On the one hand, an invoice is used to request payment for services of goods sold to a client. On the other hand, a receipt acts as proof of payment for the invoice. It’s used to document that the buyer received services or goods sold and they have paid for said goods or services.

Can I have a Cash Payment Option?

Yes, you can accept cash payments. However, this is not the best payment option to have. Cash payments are less secure, exposing you to counterfeit cash payments or losing the money before you deposit. Not forgetting the lack of a proper audit trail. Bank, mobile, or online platform methods provide you with all of this.