3 Tax Regimes To Be Aware of in 2022 For Your Small Kenyan Business

The end of the first month of 2021 is around the corner, and I believe it is a great time to remind you of taxes. Yeah, the tax season is upon us, and I doubt few people enjoy this period. But it is what it is, “render unto caesar…”

Taxes must be filed and paid in time, and this year, you must pay closer attention to the new tax regimes that might affect your small business.

Without further ado, below are the tax regimes to be aware of in 2021 regarding your small and medium business:

Digital Service Tax (DST)

This part has been updated since the government passed a finance Act that exempts Kenyan residents from paying DST.

Meet one of the newest tax regimes in Kenya that became effective on 01/01/2021, and it is causing a lot of confusion. If your business provides services via digital platforms or provides a digital platform that connects buyers and sellers, pays close attention to this.

DST applies to income earned in Kenya from services offered through the digital marketplace. KRA defines a digital marketplace as “a platform that enables direct interaction between buyers and sellers of goods and services through electronic means.”

In that sense, DST is payable by any non-resident individual or business who:

- Provides digital services

- Provides a digital marketplace

- An appointed tax representative for non-residents without a permanent establishment in the country

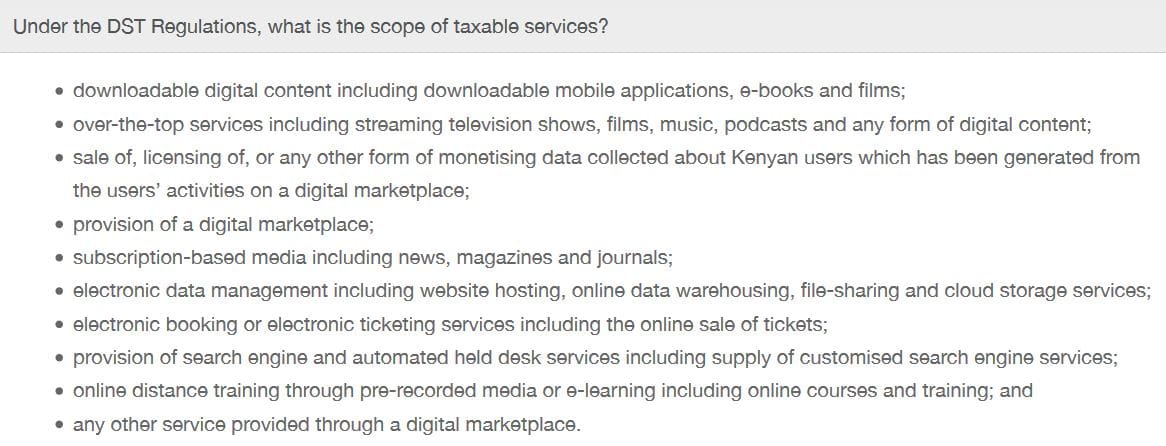

The main question on everyone’s mind now is, what services fall under DST? There are several applicable services, from downloadable content to online subscriptions, electronic booking & sale of tickets, and streaming services.

Below is a screenshot of applicable services under DST:

While the screenshot seems quite explanatory, there is still a lot of confusion regarding the services. If you have followed some of the conversations on social media sites, you might have noticed some Kenyans asking whether the DST applies to individuals earning through online gigs.

DST does not apply to goods sold through digital marketplaces, though. It applies to services only. Thus, if you sell goods like shoes and bags through digital marketplaces or social media platforms, you should file your income under the self-assessment tax regime. But if your small business provides a digital market platform for these sales to happen, like a website, and you earn a commission from hosting these sellers, then DST applies to you.

The applicable rate for DST is 1.5% on the gross value of the transaction. DST is a final tax for non-resident individuals and companies without physical establishments in the country. However, DST is a form of advance tax for residents and companies with permanent establishments in Kenya. As such, you can offset the paid DST against the annual income taxes that you will be filing in 2022.

Also, when a client withholds tax for the services you offer, like the 5% WHT for professional services, you will not have to pay DST for these services. But if there is no WHT for that service, you will have to pay the 1.5% DST.

Because there is no applicable minimum turnover for DST, ensure you register on the iTax platform for DST if it applies to your small or medium business services. For non-resident non-individuals with no permanent residence in Kenya, use this guide from KRA to register for the tax.

The first payment of DST is payable on or before the 20th day of February 2021.

Read more on the advantages of online accounting software for SMEs

Turn Over Tax (TOT)

Is the gross turnover of your small business over Kshs. 1,000,000.00 but less than Kshs. 50,000,000.00, or not expected to surpass this in a year? Then Turn Over Tax is for you.

It is a final tax and does not include the deduction of business expenses. As a final tax, it means you do not have to file the annual income tax return for your business. The advantage of this is that you can use the gross sales records to fill out the TOT excel sheet available on iTax. You do not need to hire an accountant for this, unlike the annual income tax return that requires using financial statements.

If you wish for your business to be excluded from the TOT, you have to notify the commissioner for approval.

TOT became effective on 01/01/2020 at the rate of 1% on the business’s monthly gross sales. That means you need to file and pay TOT on or before the 20th day of the following month. Failure to this, your business will be liable for:

- Kshs. 1,000 per month penalty for late filing

- 5% of the tax due as a penalty for late payment

- 1% interest on the principal tax due

TOT does not apply to the below:

- Employment income

- Business with gross sales below Kshs. 1,000,000.00 or above Kshs. 50,000,000.00.

- Rental income

- Income from professional, training, and management fees

- Income that’s subject to a final WHT (withholding tax)

It’s important to note that your business will still file and pay VAT if it has gross sales of Kshs. 5,000,000.00 and above. In this case, the liable TOT is gross amount less VAT. Here is a conversation from KRA regarding TOT that might answer any more questions you have.

Installment Tax

This is not a new tax regime. It is an advance tax paid quarterly, in 4 equal installments in anticipation of the following year’s expected income tax. If your small business is under the Turn Over Tax regime, the installment tax will not apply.

You are liable for installment tax if:

- You are an individual and non-individuals subject to tax

- You are an individual with a tax liability above Kshs. 40,000.00 in any given year and are not fully covered under PAYE (Pay As You Earn). I would recommend this to freelancers because it also saves you the headache of paying a lumpsum tax amount when filing your annual income taxes.

You can calculate installment tax by multiplying the taxes for the previous year by 110% when using the prior-year basis. Under the current year basis, which is ideal for a new business, or if your company made losses but is making profits, you calculate the installment by estimating the current year’s profit and the tax payable based on that profit estimation.

Installment tax is due every quarter, on 20th April, June, September, and December, except for taxpayers in the Agriculture sector. If you are liable for installment tax, you will pay it over this period in equal installments of 25%. The balance of the tax, based on the business’s profits, will be due by the 30th day of April the following year. So, for 2020 income taxes, the due date will be 20th April 2021.

As much as tax topics are not fun, you must be aware of the basics that apply to your business. My article is just a guide, and I urge you to speak to a tax practitioner or hire a tax accountant for your business. Whatever you do, get the tax records of your business straightened up from the word go.

This article was last updated in September to remove Minimum Tax, which was pronounced unconstitutional by the high court of Kenya in Machakos.