5 Important Things To Consider Before Taking A Loan

Last updated 20/03/2024

Are there any important things to consider before taking a loan? When you approach a financial institution for credit, what matters the most? The fact that you can have the loan processed in a few days or other terms of the loan like the interest rate and repayment period?

I was having a conversation with a friend of mine regarding debt issues many people face. For him, he never takes loans for more than 2 years. Even then, he always works towards paying off that loan before those 2 years are over. I realized that I use the same strategy, and the longest loan I’ve had was HELB.

I remember the first time I applied for a loan; my HELB was late and I needed some money for school fees. My fallback plan was a quick loan from the little savings I had in the Sacco. That was my first encounter with hidden costs. My mother encouraged me to add some money to my savings to ensure the money I received was not short of what I needed.

Read more on Student Loan Debt Payment and Management

5 Important Things to Consider Before Taking a Loan

So, here are the 5 important things to consider before taking a loan;

Why Do You Need The Money?

First, why do you need the money? There are many credit products banks and Sacco’s offer, from personal to business loans, credit cards, student loans, auto loans, and emergency loans.

While these are the most common loans available from formal institutions like banks, and Sacco’s, there is a rise in other forms of informal lenders in Kenya (2019 FinAccess Household Survey). These informal sources include Chama’s, employers, digital lenders, informal lenders, family, friends, or shopkeepers.

A loan can also be secured or unsecured, where secured loans require you to offer your personal property like a house, land, or a car as collateral for the loan. If you’re not able to meet your repayment obligation, the lender will confiscate the collateral.

Always know why you need the money so you can choose the right credit product from your lender. If the reason you need the money is not an emergency and waiting a little longer will not do any harm, I’d highly recommend you start budgeting and saving for that.

If it’s an emergency and you’ve no other choice, ensure that you follow these further steps carefully. Once you can save any little money you have from your side hustles’ income, start building an emergency fund. It will keep you from always ending up in debt when in need of some quick cash.

Interest Rates and Other Fees

The average lending rate in Kenya was 12.441%pa (per annum) in 2019, with financial institutions charging an interest of 12% to 14%. The annual interest rate the lender charges is part of what determines your monthly repayment amounts. It doesn’t hurt to shop around for the lowest interest rate.

While your lender might be offering you a lower interest rate than the competitors, have you considered whether there are other hidden costs? The extra costs could be a lump sum payment when getting the loan or be part of the monthly repayments.

Have you ever applied for a specific amount of money only for the financial institution to credit a lower amount to your account? This is common in Saccos, where you are sure you will get 3* your savings. So you try to save up to Ks. 30,000.00, apply for Ksh. 150,000.00, but you end up receiving Ksh. Ksh 140,000.00 or less. Yeah, part of the money went to cater to other costs.

Whichever the case, ensure that you have a clear understanding of what your loan rate is and any other costs included.

Some of the extra costs include:

- Negotiation fee – I have seen some Kenyan banks charge up to 2.5% of the loan amount. If you borrow Ksh. 300,000.00, you will be paying Ks. 7,500.00 as a negotiation fee.

- Appraisal fee

- Ledger fees

- Stamp duty

- Insurance fee

- Processing fees

- Credit report fee

- Failed payment – charged when your account does not have enough money to pay off the loan.

- Late payment fee – a penalty for not repaying your loan on time

- Prepayment penalty – penalty the lender charges you for paying off the loan in advance.

Confirm whether you are getting a fixed interest rate method or a reducing balance method on interest rates. The lender might be offering you a lower interest rate on fixed-rate than on reducing balance, but the total amount you pay back is the same, or one of the two methods has a lower repaid amount.

With the fixed interest rate method, you have a fixed repayment every month based on your loan’s principal amount. The fixed/flat interest method leads to higher interest repayments since your interest rate is always calculated on the principal amount, even after years of repayment.

On the other hand, the reducing balance method will charge your monthly repayment based on the current principal balance of the loan. Your monthly repayment amount is apportioned into interest and principal repayments. With this, you’ll notice that your monthly repayment reduces over the loan term as the principal balance reduces.

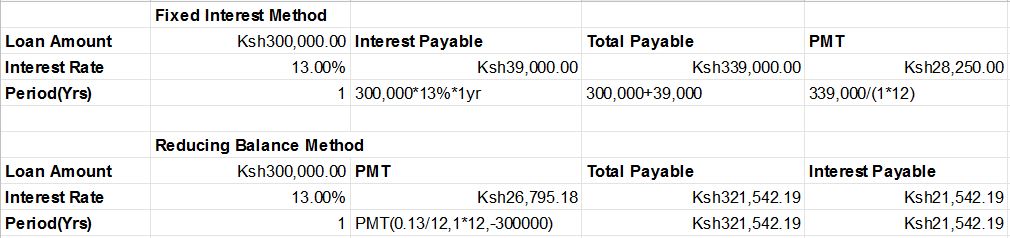

From calculations, the reducing balance method ends up being cheaper due to a lower interest amount. The below example I’ve done of a Ksh. 300,000.00 loan at the rate of 13% and 1-year term loan (12 months). The total interest payable for the fixed interest is Ksh. 39,000.00, while the total interest payable for the reduced balance loan is Ksh. 26,795.18. With the reducing balance method, you save about Ksh. 12,205.00.

The Term of the Loan

The term of the loan, or how long you will be servicing the loan, is one of the most important factors to consider. I have come to understand that there are people who focus on how long they want to pay the loan while other people don’t think about this.

In fact, some individuals are willing to take a longer term because the monthly repayments will be lower than when they have a short repayment term. The truth is that the longer the duration of your loan, the more money you’re paying back to the lender. I’d encourage you to have a shorter-term loan if you are in a position to meet the higher monthly repayment amount.

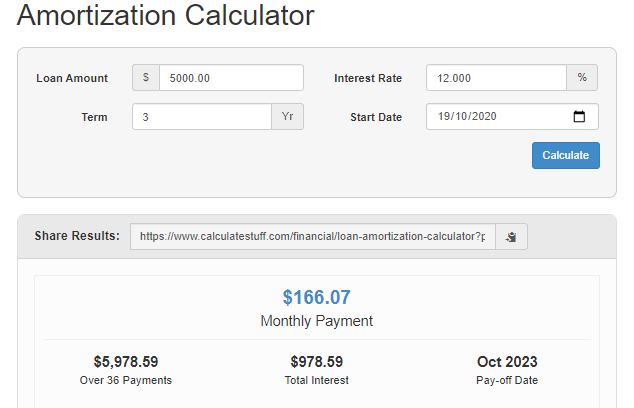

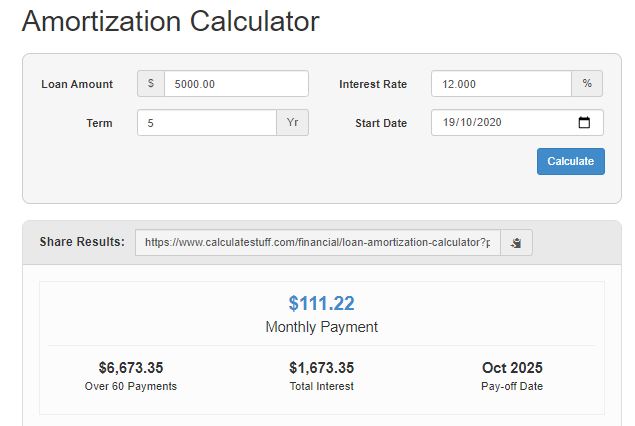

For example; I have used this calculator from Calculate Stuff to simulate the repayments of a $5,000 loan at the rate of 12% for 3 and 5-year terms. You can see that the 3-year term loan has higher monthly repayments but lower interest payable than the 5-year term loan.

3-year term loan

5-year term loan

While the decision is all yours, depending on what you can afford to pay back every month, it doesn’t hurt to consider a term that will not cost you a lot of money.

Down Payment

Some loans, like mortgages and car loans, might require you to have a down payment. Some financial institutions are even offering 100% financing on such loans. The problem is that with no down payment, you end up with a larger amount of loan to service. The loan ends up being costly compared to what you’d have paid if you had a down payment amount.

Even if you have a down payment amount, remember that the more that down payment is, the lower the and more affordable the loan will be.

Your Current Financial Situation

Are you in a position to afford the loan? When you look at your monthly and yearly budget, do you think you can afford to add another debt expense?

Forget about the sweet terms deals your lender is offering you. Have you considered how adding a loan expense to your budget affects your finances?

If you include the loan expenses in your monthly budget and see you barely have enough to survive until the next paycheck, you’re probably not in a healthy financial situation to take a loan. What you can do is lower the amount of loan you need if it’s necessary or apply for a longer term. With the latter, start working on a plan to clear the loan earlier by paying more than the minimum repayment amount or saving to pay off the loan in a lump sum before the due date.

Only take a loan for the amount you can manage to pay and still have some money left; unless you want to get deeper into debts.

Hopefully, you now have a better understanding of things to consider before taking a loan. Look for any extra costs the lender is charging you and always ask whether early repayment is allowed. Ensure that you read and understand all the terms and conditions of the loan. Most importantly, be sure that you can afford to add debt expenses to your monthly budget.

FAQ

How Much Debt Is Too Much Debt?

There’s no one-size-fits-all answer, but a good rule of thumb is to avoid exceeding 50% of your gross income in total debt obligations (excluding mortgages). This ensures manageable monthly payments and leaves room for emergencies and savings.

What Are Some Signs I Shouldn’t Take a Loan Right Now?

Red flags include struggling to meet current financial obligations, having limited emergency savings, or an unstable income source. Additionally, if the loan purpose isn’t a clear investment in your future (e.g., education, business), it might be wise to wait.

What Should I Do If I’m Struggling To Repay My Loan?

If you find yourself struggling to repay your loan, the first step is to communicate with your lender as soon as possible. Many lenders are willing to work with borrowers to restructure their loans, extend the repayment period, or find other solutions to avoid default. Additionally, consider seeking advice from a financial advisor to explore your options for managing the debt.

Can Taking a Loan Improve My Credit Score?

Yes, taking a loan and managing it responsibly by making timely payments can improve your credit score. This demonstrates to lenders that you are a reliable borrower, which can positively impact your credit history. However, it’s important to borrow within your means and not to take on more debt than you can afford to repay.

Nekesa

So spot on.. ???

Enid Kathambi

Thank you!

Sharon Ogugu

Such great advice! Like you, I am for the idea of only taking loans when absolutely necessary. I’ve learned quite a lot from this article. Thanks for sharing, Enid.

Enid Kathambi

Hey Sharon, thank you for your feedback. I am glad this article was useful to you. I’d like to hear your feedback about building an emergency fund.