6 Personal Finance Gifts For Your Loved Ones

Disclosure: This article uses affiliate links, which may earn a commission at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases.

Let’s talk about gifts, more so, the type of personal finance gifts you can give your loved ones to help them through their personal finance journey.

I know it is August, and the holiday season is a few months down the line. But it is never the wrong time to give people gifts, right? It could be birthday gifts, Father’s Day gifts, Mother’s Day gifts, anniversary gifts, or random gifts for no reason whatsoever!

As we talk more about personal finance management, the hope is never to leave our loved ones behind. In fact, this is one of the best ways we can dismantle the black tax burden for our future generations. So perhaps you can start by gifting them items that get them closer to their personal finance goals?

Personal Finance Gifts For Your Loved Ones

Here are a few ideas to consider:

Money Management Books

I would suggest getting people in your life books any time and at all times; physical books, Kindle editions, and audiobooks. Whatever book format they love! I am just a sucker for books. And book gifts are my favorite kind of gift.

You can buy whatever genre they love. That said, I would suggest sticking to books on financial literacy when it comes to personal finance gifts. Whether your loved one is just starting their personal finance journey or they have been at it for a while, there is a book in the business, finance, or economics genre that would enhance their knowledge.

I might not have read a tone of these (save for course books, LOL), but I have a few recommendations:

- The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel -This is easy to read and follow, making it an excellent pick for anyone starting their personal finance journey. Buy on Amazon.

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns by John C. Bogle – is ideal for investing topics for beginners. Buy on Amazon.

- The Path: Accelerating Your Journey to Financial Freedom by Peter Mallouk with Tony Robbins – is also ideal for a beginner. Buy on Amazon.

- Why Women are Poorer Than Men and What We Can Do About It by Annabelle Williams – I recommend this to EVERYONE! Buy on Amazon.

- Think Like a Breadwinner by Jennifer Barrett – Buy on Amazon

- How to Become a Lifelong Financial Success by Manyara Kirago – read my review here

- The Lean Startup by Eric Ries – for your loved ones interested in entrepreneurship – Buy on Amazon

- The Intelligent Investor by Benjamin Graham – Buy on Amazon

- Total Money Makeover by Dave Ramsey – Buy on Amazon

Of course, these are just suggestions. Shop around and research what the books you choose are about. Alternatively, you could ask them if they have a list of books in this genre that they would want to read and get those.

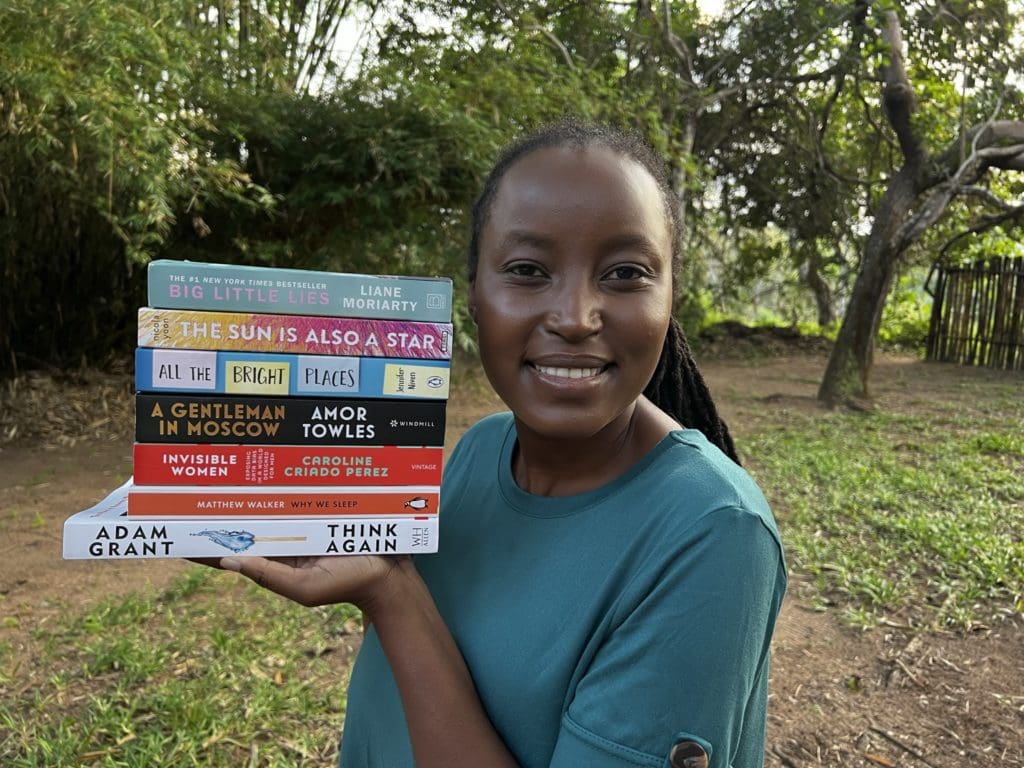

My pile of birthday book gifts

Personal Finance Planners

Financial planning is a never-ending process. A financial planner can go a long way in helping a loved one plan and track their finances and goals.

Budgeting Planner

Consider gifting a comprehensive budgeting planner that goes beyond the basics. Choose planners that offer insightful prompts, goal-setting sections, and expense trackers. These tools not only assist in day-to-day financial management but also encourage long-term financial planning, fostering a habit of mindful spending and saving.

Shop our available Budgeting Tools

End of Life Planners

While it may seem unconventional, gifting an end-of-life planner is a thoughtful gesture that demonstrates care and concern for their future and that of their loved ones. These planners can help a loved one with the organization of crucial documents, such as wills, advance directives, and insurance policies, ensuring peace of mind and a smooth transition for their estate in the future.

Looking for an End of Life Planner? Buy on Amazon

Money

Who wouldn’t want a few extra shillings or dollars in their pocket? In this economy, I know I would. Sometimes, you can just gift people money or a voucher and let them decide what to do with it. It could go into their savings accounts, shopping for the house, or meet some unexpected emergencies they might face. Whichever way they use the money, that is extra money they did not have or expect in the first place.

Piggy Bank

Speaking of money, how do you teach the children in your life about money? Do you have kids, nieces, nephews, or children you mentor?

There are many ways to teach kids about money. And it is quite necessary, to be honest. It will help bring up a generation of young adults who know how to manage money and debts. The secret is to start these lessons early.

A piggy bank can go a long way in these lessons. It will teach them to save and appreciate delayed gratification. Some banks and Saccos have piggy bank accounts; basically, bank accounts for kids and teenagers. They offer kids a piggy bank for saving money at home, and they can later deposit it in their bank savings accounts. You can also encourage these children by putting a few coins in their piggy bank as a gift.

Courses

We are forever learning, and online courses have made learning easier in this digital era. Gifting a loved one a course might not look like a personal finance gift but let me assure you it is.

For starters, there are numerous personal finance courses you can gift someone, whether they want to learn more about debt management, savings, investments or retirement planning. Make a point of asking what personal finance topics trouble them, and they could use extra help. Then, purchase courses for them on these topics.

Second, you could get them courses that enhance their skills for better job opportunities. I mentioned in my previous post that not everyone is meant to be an entrepreneur, and you can reach your financial goals by focusing solely on employment. One of the ways to make more money from your career is to keep your skills up to par. So, is your loved one looking to enhance their skills in any field? Are they hoping for better job opportunities by learning or improving specific skills? Or are they pursuing any professional, undergraduate, or postgraduate courses, etc.?

Third, they might be looking for a side hustle or starting a business. Anyone who has taken either of these paths knows a few lessons can help you achieve your goals. You can support your friends or relatives by gifting them courses that enable them to learn a few things about entrepreneurship, business management, business finance management or even to get new skills in a different industry for a side hustle.

Your personal finance gift, in this case, would be paying for their course, whether in whole or partially. So you will be saving them the cash they would otherwise use while still pushing them towards enhancing their skills for better employment or business opportunities.

Invest in their businesses or side hustles

Besides gifting one a course that helps push their side hustle or business, you can invest in the said business or side hustle. For instance, are there tools they need to improve the business or side hustle? Maybe they need a laptop, camera, furniture, startup money, or hosting for their website. If you help start and grow their business, you are helping them achieve financial success.

Whatever gift you choose, remember that personal finance topics can be touchy. Some people do not like talking about their financial situation. Sometimes, your gift might be well-intentioned, but will they see it that way? It is important to be mindful of what you gift people when it comes to money topics.