Are You Ready to Set Your Financial Goals For 2024?

Updated 02/02/2024

It’s already a month into 2024, and some of those resolutions are starting to fade away- mine being exercising and keeping fit. I will get to it, I am sure. What I am keeping at, though, is my resolution for better financial health this year.

I have been going through my finances and updating the necessary for the last few days. Because my December holiday season and the better part of January were filled with ups and downs, I have had to redefine most of my financial goals. Including those that I had made one or two years back. Still, the experience has given me a new perspective on my financial goals and management.

One of them, which is not a new realization for me, is that you can always set new financial goals and redefine those that you already have. If you are starting your journey in personal finance, it’s important to note that your financial goals list is not a static document. It’s a road map that changes as your life and dreams change.

So, if you are on the fence about what to do to your financial goals given the new changes in your life, it’s time to incorporate them into your road map for better planning. And if you have not started your journey toward financial success, there’s never a better time than now. In this article, I will take you through the most crucial tips to help you set collide financial goals.

Are you ready to set your financial goals for 2024?

How to Set Your Financial Goals for 2024 and Beyond

Step 1: Assess Your Current Situation

First things first, where do you stand? Are you too deep in debt?

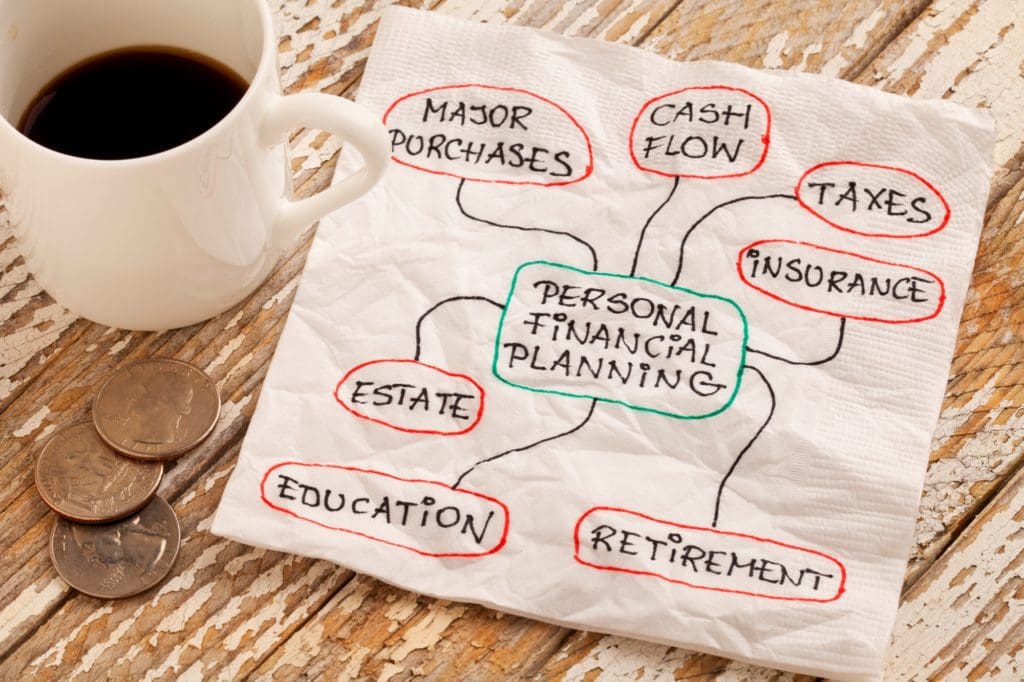

Financial planning starts with self-awareness. Start by scrutinizing your income and expenses, gaining a comprehensive understanding of your cash flow. Identify sources of income, fixed expenses, and discretionary spending, laying the groundwork for informed decision-making.

Next, evaluate your debt and liabilities. Review outstanding loans and credit card balances and develop a plan to manage and ultimately reduce debt. Don’t forget to assess your risks to ensure you get the right risk management tools, including insurance policies.

How are your savings accounts and investments? Are the balances in the accounts aligning with your calculations? Did you liquidate some accounts? Or open new ones?

Besides these, you also need to think about your estate planning. What would happen to your loved ones, investments, and assets if you were no longer there? Death is inevitable and is often sudden and unexpected. An estate plan ensures that you prepare for this inevitability and cushion your loved ones as much as you can.

This reflection sets the stage for a realistic and achievable goal-setting process.

Step 2: Redefining Your Financial Goals

By now, you should have reviewed your 2023 financial goals, congratulated yourself for the ones you achieved, and redefined those that you did not achieve. While 2023 taught us that things could change abruptly, it also taught us to be very flexible with our goals and plans.

So, whatever financial goals you set this year, have some flexibility. Most importantly, be very clear with your financial goals. You cannot measure your progress from a vague description. Your financial goals must follow the SMART (Specific, Measurable, Attainable, Relevant, and Time-bound) strategy.

Rather than having a “pay debt” goal, define it as “I want to pay Ksh. 100,000.00 bank debt and have Ksh. 100,000.00 in my savings account by August 2021”.

With this, you can easily plan how much you need to save every month for the savings account and the loan repayment and start working towards it.

Remember to separate your goals into short-term and long-term. It makes it easy to set a realistic timeline for each goal.

Short Term Goals

Short-term financial goals are those that you need to achieve within the year. Your short-term goals should include items like:

- Building an emergency fund if you have none yet or yours is yet to hit the ideal target. An emergency fund must have at least 6 months of your monthly expenses. If you can increase this to 12 months of expenses, the better. With what we experienced in 2023, I am definitely working towards a 12-month emergency kitty.

- Paying off short-term debts, like mobile loans, credit card debts, and debt from individuals.

- Tweaking your monthly budget, which is easy if you have a reference point from your 2023 budget. Find out if you can cut from your expenses, so you have more money to save. If not, do not sweat it. There is only too much one can cut from their expenses.

- Saving for travel – start saving for this year’s vacation and other travel plans you might have, whether you are taking it at the end of the year or mid-year.

- Major household expenses – for any significant household purchases or renovations you are thinking of undertaking, start setting money aside in advance. I would advise putting this money in a high-yield short-term investment account, like a money market fund account. Alternatively, you can save in a Sacco and borrow to leverage against your deposits.

Related post: My Experience Investing in Money Market Funds

Long Term Goals

On the other hand, long-term financial goals require investing for more than a year. These include:

- Saving for your retirement – if your employer does not offer a pension plan, you need to open an individual pension plan. The sooner you start saving for retirement, the sooner your money can begin to benefit from compounding interest. Apart from saving for retirement, the pension contributions will also help you reduce your tax liability.

- Building an education fund – the cost of a college education has gone up. In the coming years, we can still expect the cost of education to keep going up. That, plus the monthly expenses, like accommodation and meals, the price will be too high. Start saving for your kid’s college in advance, and let the money earn from compounding interest.

- Homeownership – start saving for that mortgage deposit you need to make to buy your home. If you are planning to build, start saving for that, too. That includes factoring in the purchase of the parcel you want to build in and the current costs of construction plus inflation.

These are just a few of the short and long-term goals. Keep in mind that everyone’s financial journey is different. What your loved ones and friends have in their financial goals list is different from what you should have. Your financial goals should align with your values and what you want to achieve within each specific period.

Learn more in a related post: Individual Pension Plan; Why You Need One

Step 3: Create Your Budget Plan

You cannot achieve any financial goals without a clear budget. You need to know how much money you bring in, where it goes, and what you can tweak in your budget to achieve your set financial goals.

First things first, do you have a budget for 2024? If not, start by creating one. Gather all your bank and mobile money statements so you can track the expenses from the last 3 months or so. It will help you figure out how much you spend every month on utilities, debt repayments, and other variable expenses.

If you already have a budget in place, you can use it to estimate your 2024 income and expenses. Try to revise it to suit your 2024 financial goals.

If one of your goals is to save more or build an emergency fund, you need to find ways to reduce your expenses, like money spent on variables. If there is no expense to reduce, you need to figure out ways to make extra income to achieve this goal.

The rule of thumb when it comes to budgeting is to use the 50/30/20 strategy. 50% of your income should go towards your necessities, rent, food, transport, and utility bills. 30% is for your wants, like entertainment. The remaining 20% is what you channel towards your savings. This rule might not work, but you can adjust the percentages, like reducing entertainment costs and putting that money towards savings or debt repayment.

However, this is not the only budget strategy to use. There are other budgeting methods you can try, including zero-based budgeting methods, paying yourself first, and the envelope budgeting system.

Next, choose a budgeting tool to use. Are you a spreadsheet type of person or do you prefer writing things down in a planner? Or, do you prefer the digital methods where you can sync a budgeting app to your financial accounts? The choice is all up to you. However, it’s important to ensure that you have a budgeting tool that is easy and fun to use.

Get your affordable budgeting tool from my shop today!

Most importantly, review your budget regularly and make any necessary adjustments. Again, nothing is fixed; life changes, and you should be ready to accommodate any unexpected changes in your budget.

Step 4: Learn More About Personal Finance Planning

This is the year you need to start learning more about managing your finances. It is the only way you will get skills to handle your financial matters, from savings to investment and budgeting, among others.

I know the math or accounting bit of finances might not be appealing, but if you want to achieve your financial goals, learn at least the basics.

Luckily, the internet never disappoints when it comes to getting information. Here are some of the contents to look for:

- Read personal finance blogs

- Listen to personal finance podcasts – subscribe to my podcast

- Get a financial advisor

- Subscribe to magazines with personal finance topics

- Start reading books on finance practices, like saving and investing – get recommendations here

- Learn more about debt management

- Join online discussions on personal finance topics – sometimes, it is good to share or hear others’ ideas. Their methods might not work for you, but you can learn a few things from their experiences. You can join our community here.

What financial resolutions have you made this year to achieve better financial health? Hopefully, this guide helps you set your resolutions if you are late to the party, and you can start working towards financial independence.

FAQ

Why is setting financial goals important?

Setting financial goals provides a roadmap for your financial journey. It helps you prioritize, allocate resources efficiently, and work towards specific objectives, ultimately contributing to long-term financial stability.

What if my financial goals change over time?

It’s natural for goals to evolve with life changes. Regularly reassess your goals and make adjustments as needed. Flexibility is key to maintaining a realistic and achievable financial plan.

What are the most important things to consider when setting financial goals?

The SMART framework (Specific, Measurable, Achievable, Relevant, and Time-bound) is crucial. Be clear about your desired outcome, quantify it, ensure it’s realistic, align it with your values, and set deadlines. Additionally, consider your current financial situation, including income, expenses, debts, and assets.

How often should I review and adjust my financial goals?

Regularly review your goals, ideally every quarter or at the beginning of each year. As your circumstances and priorities evolve, your goals may need to be adjusted to remain relevant and achievable. Don’t be afraid to adapt your plan as needed.

How do I prioritize between short-term and long-term goals?

Prioritization depends on your individual circumstances and aspirations. Essential living expenses and financial security goals often take precedence in the short term, while long-term goals like retirement planning require consistent attention due to the compounding effect.

How can I break down large financial goals into smaller, manageable steps?

Start by identifying the key milestones needed to achieve your larger goal. Then, further, break down each milestone into actionable tasks you can accomplish within a specific timeframe. Regularly monitoring your progress towards these smaller steps can help maintain momentum.

How can I stay motivated and avoid setbacks when pursuing my financial goals?

Track your progress and celebrate milestones, no matter how small. Share your goals with supportive individuals or communities for accountability. Reward yourself for reaching milestones to maintain motivation. Remember, setbacks are inevitable. Develop a plan to address them and get back on track.

Is it necessary to consult a financial advisor when setting goals?

While not mandatory, consulting a financial advisor can provide valuable insights and expertise. They can help tailor a plan to your specific situation, offer investment advice, and guide achieving your financial objectives.