3 Common Mistakes to Avoid When Using SWIFT Codes

While I talked about the common mistakes to avoid when using SWIFT codes in this last article, it was only in passing. The article was mainly about how to search for SWIFT codes. But in this article, I want to talk in detail about the importance of getting your bank’s SWIFT code details correctly when processing payments.

Let’s get right into it.

Don’t miss this related article! Invoicing And Payment Terms You Need To Know

The Basics of SWIFT Codes

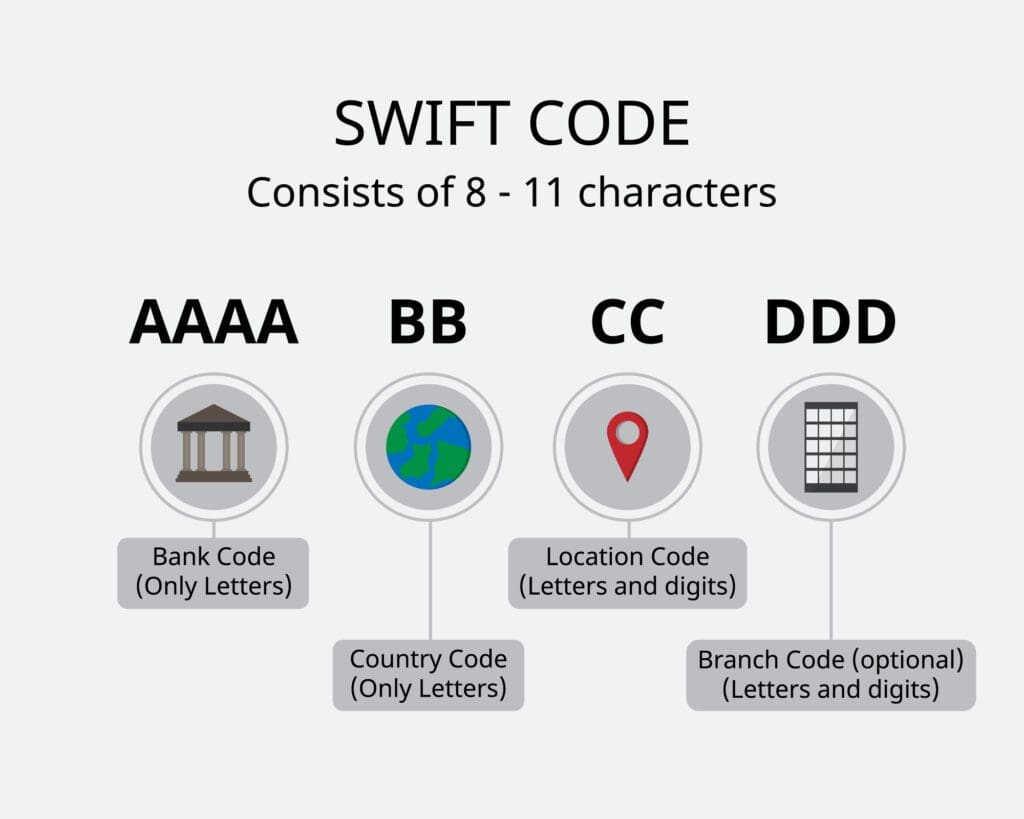

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique eleven-character alphanumeric code assigned to every bank and financial institution globally. It serves as a critical identification tool used by banks to route international money transfers between each other. When you initiate an international payment, you’ll typically be required to provide the recipient’s SWIFT code alongside other bank details.

As it is with other payment transactions, capturing the correct details is important. You don’t want to put your business in a situation of delayed supplier payments, not forgetting the wasted time and possible costs caused by payment errors.

3 Common Mistakes to Avoid When Using SWIFT Codes

As a business owner, it’s important to understand the basics of banking terms and processes. One of these is SWIFT transfers. This is even more important if you engage in international payment processing. Here’s a list of the most common mistakes to avoid when using SWIFT codes and why it’s important to ensure accuracy.

1. Typos and Misspellings

One of the most frequent errors occurs during the manual entry of SWIFT codes. A single typo or misspelling, even a seemingly insignificant one, can render the code invalid and prevent your transfer from being processed.

To minimize this risk, it’s highly recommended to copy and paste the SWIFT code directly from a reliable source like the recipient’s bank website or official documentation. If manual entry is unavoidable, double-check the code meticulously before finalizing the transaction.

Fortunately, a lot of financial institutions have integrated the available SWIFT codes into their systems. All you have to do is enter your beneficiary’s bank name and a list of available SWIFT codes is populated. This helps remove the manual entry process, helping you reduce the chances of typos and misspellings.

2. Incorrect Formatting

SWIFT codes follow a specific standardized format consisting of eleven characters:

- First four characters – Bank Identifier Code (identifies the specific bank)

- Next two characters – Country Code (identifies the country where the bank is located)

- Next two characters – Location Code (identifies the city or region where the bank is located)

- Last three characters – Branch Code (identifies the specific branch within the bank)

It’s very important to avoid using spaces, special characters, or any formatting that deviates from this standard format. Ensure the code is entered as a single, continuous string of eleven alphanumeric characters.

For instance, the correct format for the SWIFT code of Equity Bank’s headquarters branch in Nairobi, Kenya, is EQKEKEKENXXX. Entering the code as “EQKE KEKE NXXX” or “eqkekekenxxx” would be considered incorrect formatting and could lead to processing errors.

3. Using Outdated or Inaccurate Information

Banks may occasionally change their SWIFT codes due to mergers, acquisitions, or internal restructuring. This can lead to changes in the financial information of the institution, including its SWIFT code. Using an outdated or inaccurate SWIFT code can be just as detrimental as an incorrectly formatted one.

To ensure you’re using the most current and accurate code, it’s essential to obtain the code directly from the recipient’s bank through their website, official documents, or by contacting them directly. Relying on third-party sources or outdated information can increase the risk of errors and delays in your transfer. Additionally, if your beneficiaries’ details are already in your bank’s list of payees, it’s important to review these details regularly to ensure accuracy.

FAQ

When Do I need a SWIFT code?

You will need a SWIFT code whenever you initiate an international money transfer, either sending or receiving funds. The recipient’s bank will require you to provide their SWIFT code alongside other bank details to ensure the funds reach the correct destination.

How Can I Verify the Accuracy of a SWIFT Code?

You can verify the accuracy of a SWIFT code by contacting the respective bank directly, using online banking platforms, or utilizing official online tools provided by financial institutions. Cross-referencing the code with updated and reliable sources ensures that you have the correct and current information before initiating any international transactions.

Why is it Important to Stay Informed about SWIFT Code Updates?

SWIFT codes are subject to periodic updates due to changes in financial institutions’ structures, locations, or mergers. Ignoring these updates may result in transaction failures or delays. Staying informed about SWIFT code changes ensures that your transactions align with the most current and accurate information, reducing the risk of errors.