Understanding Estate Planning

Have you started your estate planning process? The thing is, we have an estate to plan for. And not an estate in terms of property. It is all about what you own, from your laptops and computer system to furniture, money in the bank, equities, bonds, your car, and real estate.

Since you own your belongings, it is only proper that you get to decide what happens to your estate when you leave this world or when you can no longer look after them.

Unfortunately, we cannot live forever. Today, you are alive and healthy, but you cannot predict what will happen tomorrow.

Now is the time to make plans for your belongings.

At some point in life, many people lose the ability to make decisions for themselves. Incapacitation may be a result of sickness or old age. If this happens, you have to rely on others to make decisions for you. Even if you can no longer make healthcare decisions for yourself, would you not rather have a say on who makes decisions for you?

People delay estate planning for many reasons. Sometimes they believe they do not own a lot, or they are too young to die. But this is a dangerous way to view matters. No one can predict when or how they will die. Apart from this, death is not the only reason to have an estate plan.

Other people have the erroneous belief that estate planning should be limited to wealthy people. Wealthy people are indeed more concerned about estate planning than others because they have more to lose. But everyone should have plans for their estate. Even if you are not wealthy, you should make provisions for your family if you pass unexpectedly.

So, let’s talk about wills and trusts, as they are the most popular tools for estate planning.

Read: This is What Happens If You Outlive Term Insurance

Estate Planning Documents

Estate planning is more than just leaving a will to distribute your assets. It encompasses other details, like appointing a medical proxy or leaving a trust. Here are some of the important documentations that form estate planning:

Wills (Testament)

A last will is a document that provides instructions about how to distribute your assets at death. You may also use a will to appoint guardians for your children in the event of death and executor for your estate.

Although they are your direct instructions, wills are still subject to state probate laws. For example, probate laws may override your choices if you are divorced.

Only an attorney is authorized to draft wills. You may also decide to make one yourself. However, if your testament is incomplete, it becomes invalid in the eyes of the law, and probate laws will apply instead.

Create or adjust a will only when you are sound in mind. If a disgruntled heir believes they can prove you made the will when you were not in sound mind, they may approach the court for justice. The court may rule in their favor. Therefore, ensure you put your affairs in good order.

If you do not have a will, make one immediately! You should also review your testament periodically and ensure it is up to date. If there are significant events in your life like marriage, divorce, childbirth, or inheritance, ensure you update and adjust your will.

Read about: Financial Checkup: Take Stock of Your Financial Health

If you die without making a will, the state will take over in distributing your assets, and it might not be what you had in mind.

Living Trusts

Living trusts are another popular choice in estate planning. Probates can be expensive. If you would like to avoid probate, create a trust and transfer your assets to it. When you pass away, the trustee will apportion the assets based on your instructions. It is similar to the way an executor executes a will.

You combine wills and trusts in your estate plan. If there are any other assets, the ‘pour-over will’ acts on them.

Probates are a one-off event while living trusts can exist for a long time. Trusts are an excellent way to support vulnerable loved ones. Vulnerable loved ones may include people with a history of substance abuse, relatives with abusive spouses, or people living with a disability.

Power of Attorney

Due to illness or old age, people may become incapacitated and lose the ability to make decisions. When this happens, others have to act for them.

While trusts allow successor trustees to make decisions for you before death, a will does not. If you create a testament for your estate, ensure you provide for powers of attorney to allow trusted persons to take financial decisions on your behalf.

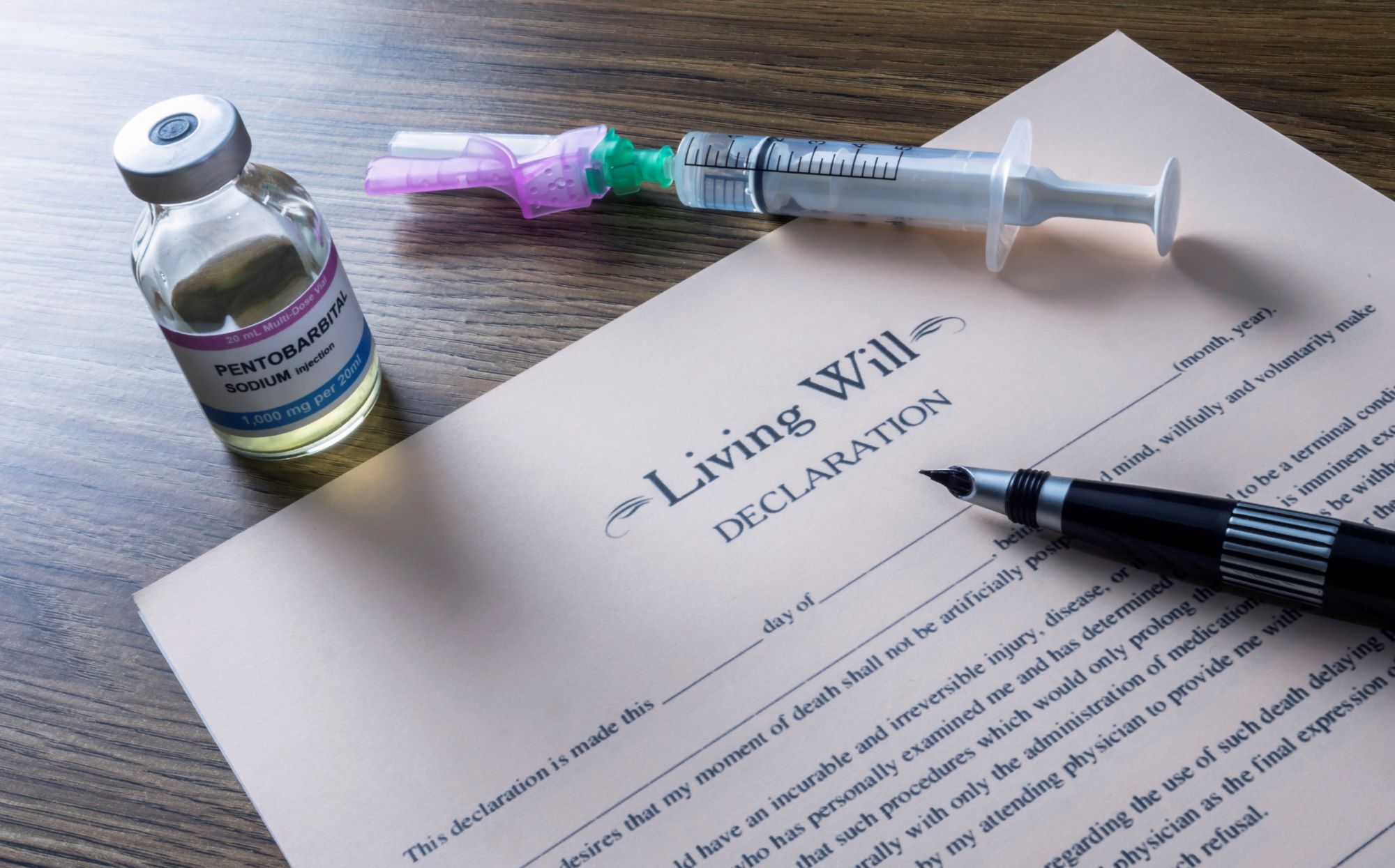

Health Care Directives

You could be alive but not in a position to make decisions regarding your healthcare. This is where a medical directive or proxy comes in handy. It allows you to choose an agent who can legally make healthcare directions on your behalf in the event you’re not able to do so yourself.

Benefits of Estate Planning

When I discuss estate planning with some people, the first comment they make is that they think they have no assets to distribute. But, as mentioned above, any asset you possess is worth leaving clear instructions.

The second comment is usually of what importance is estate planning? Well, it is an integral part of planning your personal finances, and here is why you need to do it:

Record keeping

An estate plan helps you keep accurate records of your property and your beneficiaries. Without detailed documentation, your loved ones may not know what assets you own or where to find your titles and other documents.

Reduced expenses

Estate planning also helps you to minimize taxes and other legal expenses. You may do these through trusts and completing beneficiary designations.

Succession

If you own a business, dying intestate may cause problems if there is no clear succession plan. Your heirs may begin to jostle for the control of your business, ruining the business. An adequate estate plan will ensure a smooth transfer of your business to your preferred heirs. And others have to accept your decision.

Safeguard your children

Minor children need responsible guardians if anything happens to their parents. With a will, you can make provisions for their protection and safety.

Peace of mind

Estate plans leave you and your family with peace of mind. You know that in the event of any death or incapacity, you have done your best.

Avoid conflicts

You have probably lived to witness family conflicts ensuing after one passes on. So, don’t let that be you, or rather, your beneficiaries.

Get an expert to help plan your estate. An expert helps ensure that you do everything right and avoid having your will invalidated. It will, of course, lead to intestate succession. In hindsight, this will be a wise decision. Wills and trust are not expensive. Protect your choices and your loved ones by creating a complete will that is legally valid.

Marlow Marione

Very insightful

Enid Kathambi

Thank you, Marlow