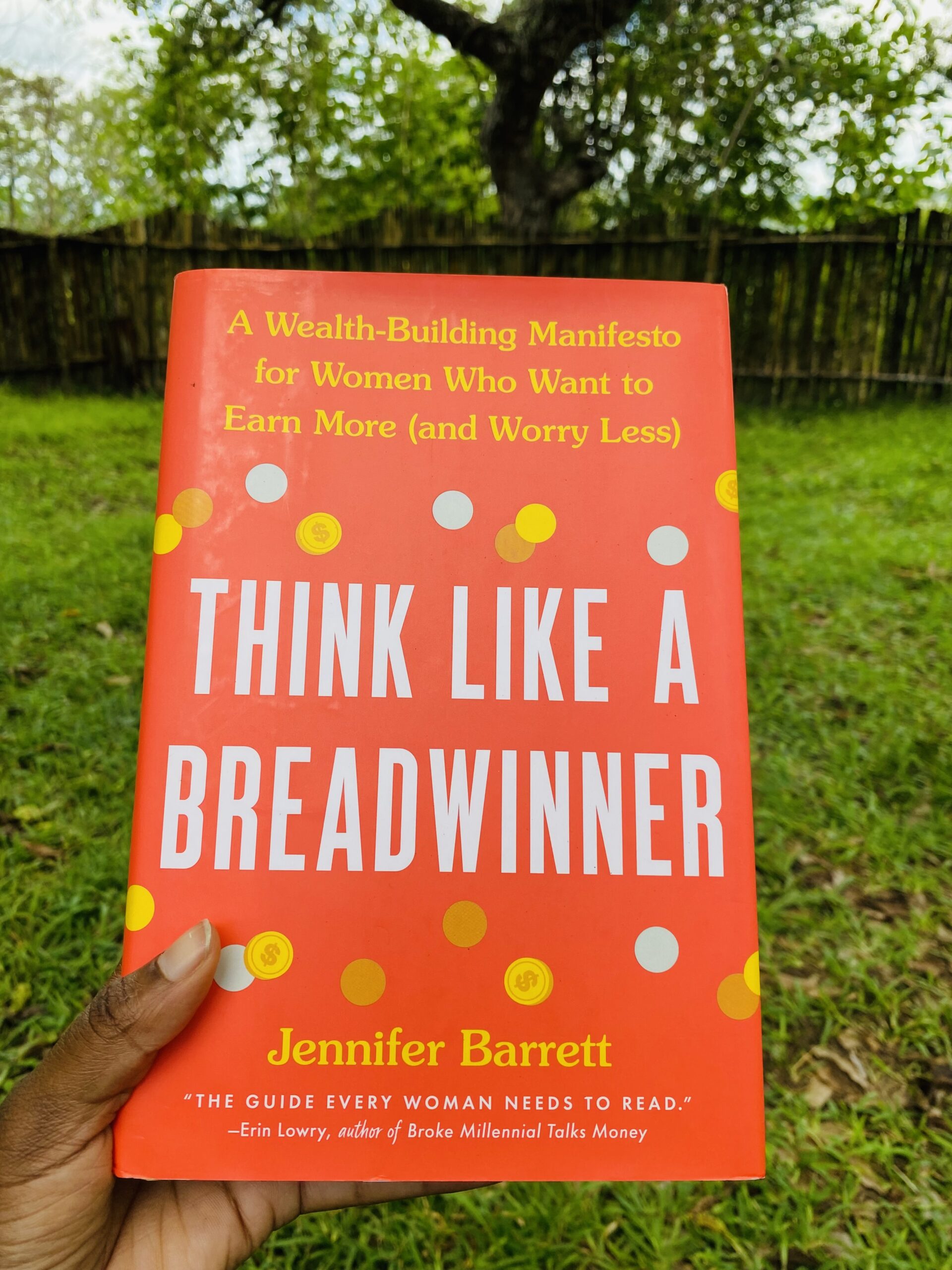

Think Like a Breadwinner: A Wealth-Building Manifesto for Women Who Want to Earn More (and Worry Less) by Jennifer Barrett

Disclosure: This website uses affiliate links, which may earn a commission at no additional cost to you. As an Amazon Associate, I earn from qualifying purchases.

About the Book

Title: Think Like a Breadwinner: A Wealth-Building Manifesto for Women Who Want to Earn More (and Worry Less)

Author: Jennifer Barrett

Genre: Nonfiction, Finance, Money, Personal Finance, Self Help, Feminism, Business

Publisher: G.P. Putnam’s Sons

Publication Date: April, 2021

Pages: 352, Hardcover

Think Like a Breadwinner by Jennifer Barrett focuses on one major thing: making women rethink their positions as providers, whether they are in a relationship or not. The author’s goal, as I gather from the book title, is to help women build wealth and worry less about their financial well-being.

Did the author achieve all this? I am still skeptical.

There are a few disclaimers. First, the book’s main focus, even the data used, is mainly on the American market. But don’t brush it off yet because there is still a lesson, or more, for everyone. Second, and one that the author pointed out as an exception at the beginning of the book, is, and I quote,

“This move toward female breadwinning has been significant and relatively recent. With one exception. A significant percentage of Black mothers are the primary source of economic support for their families—and that has been the case for decades.”

I was reading this, and at the back of my mind, I was like, “Tell me something new.”

Get Your Copy of Think Like a Breadwinner by Jennifer Barrett

But I digress. Back to the book.

First, I loved the storytelling and personalized approach, including stories from other women she interviewed. It made the book a quick read and relatable. The nudge to see yourself as a breadwinner regardless of your relationship status is seen in these stories. Some are married to a partner who is making more. Soon, these women advance careerwise and earn more than their partners. Or the partner loses their job. Others, you plan a life with someone and one day down the road, you are a single parent, either divorced or widowed. In each scenario, women found themselves as breadwinners, a situation they never thought they would be in.

As the author points out at the beginning, this will only be a brand-new concept for some.

However, one of the points the author argues is that we are never taught how to invest and grow our money. Even if being a breadwinner is familiar to you, there is a high chance no one taught you about investing and debt management. So, we earn, spend, and save the rest in a bank account. That money sits in low-yielding accounts for years, earning little to no interest and never beating inflation. When you think like a breadwinner, you think about the future. And that includes putting the extra money into investments that bring passive income and appreciate in value. That’s the mindset of a breadwinner: not thinking about the present only but also the future and looking for ways to future-proof your finances.

My Take of Think Like a Breadwinner

What I loved most about the book is the simplicity with which the author captures some of our deep-rooted and unconscious biases and assumptions about money that keep us from future-proofing our finances. Especially women who are or hope to be in a two-income household. The upbringing that the male partner is the provider, even if you earn, has made many take a seat back. From the countless tales we grew up with and the movies, we watch to the books we read about the grand princess treatment by a prince charming who always comes to the rescue.

As such, we do not negotiate for better employment terms, like higher salaries, benefits, and other perks. Even when one does, there is a possibility of failing to go hard enough, like accepting mediocre increments and job offers, when others do it and get more. Sadly, it impacts everything. Because you need more income to have enough money to save and invest. On this, the author advises about how to negotiate and get paid your worth.

Also, the comfort of knowing someone else is taking care of all the finances means you do not have a front seat row in everything they do about the family finances. This has led to many women being divorced and left with nothing. Or partner’s plundering all the family savings and investments. Because they are seen as financially responsible persons in the relationship, they are left without any accountability.

These and other points about earning and managing your money, which act as a wake-up call or reminder that we need to be financially independent, are why I recommend this book to a beginner. It doesn’t matter whether you are partnered or not. Whether you have kids or not. It is a good read to get you working on your finances.

Unfortunately, the chapter on investing was just glossed over. There is nothing much about building wealth. Plus, some money-saving and investing suggestions will not make sense if you are not American. I also found the book redundant. For a book with such a title, I was honestly expecting more.

If you are starting to work on your finances, this would be an excellent read to get you started. Or if you need a dose of motivation as you work on your finances. However, if you are looking for more, a book that talks more about investing, this will feel underwhelming. Books like The Little Book of Common Sense Investing and The Intelligent Investor would be ideal for you.

Get Your Copy of Think Like a Breadwinner by Jennifer Barrett

Get your next read inspiration here.

My ★ Rating 4.0

Goodreads ★ Rating 4.12 (as of October 2022)