Description

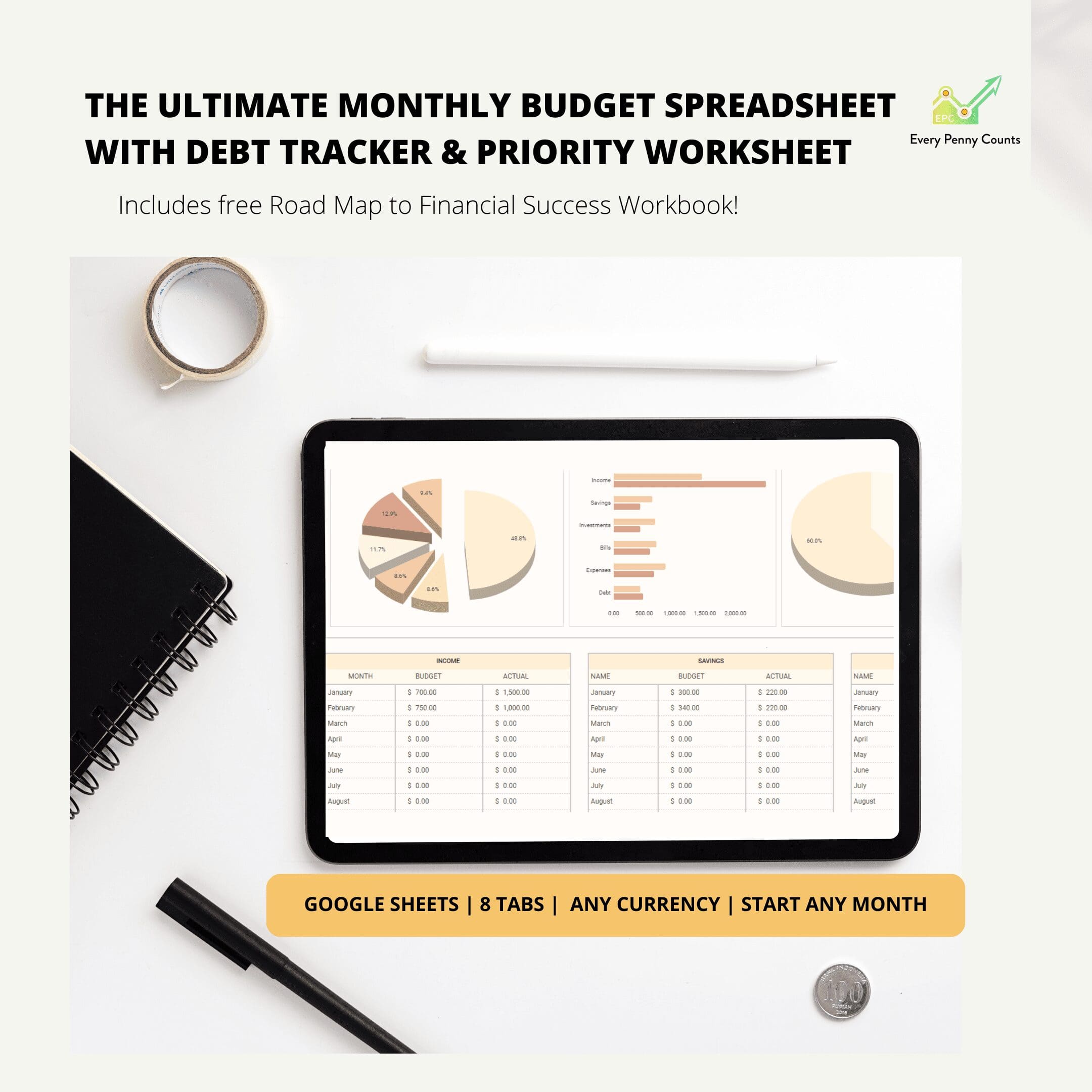

The Ultimate Monthly Budget Spreadsheet Template for Google Sheets is your go-to budgeting spreadsheet for all the cool features at an affordable price. It makes budgeting fun and easy with a duplicatable budgeting dashboard and calendar to help you stay on top of your finances. It’s an easy-to-use template with a User Guide, automated formulas, and charts!

Here’s what the Ultimate Monthly Budget Spreadsheet offers:

✅ EASY TO USE – Has a detailed setup guide tab with user instructions, plus a set-up page for categories linked to the budget tab, debts, savings & Priority trackers.

✅ ANY CURRENCY USE – Set your currency preference & it auto-updates across the template.

✅ FINANCIAL GOALS – Automated Savings/Sinking Funds goal tab for tracking your progress.

✅ BILL CALENDAR – Calendar for tracking your bills, subscriptions, and debt repayment dates.

✅ BUDGET OVERVIEW – A budget overview of your planned amounts for income, bills, savings, debts, and expenses.

✅ DEBT PAYOFF WORKSHEET – Looking to get out of debt? The Debt Tracker allows you to choose between the Debt Snowball /Avalanche strategies, automatically organizing your debt based on your preferred method to show you what debts to focus on and possible payoff dates.

✅ PRIORITY WORKSHEET – Need to save more and don’t know how? Use the Priority Worksheet to identify the most important and not-so-important spending.

✅ DATE PICKER – Simply double-click on cells for dates and pick the correct transaction date from the pop-up calendar.

✅ GOOGLE SHEETS COMPATIBLE – Designed for working specifically with Google Sheets. You just need a Google Account.

✅ INSTANT ACCESS – Instant access after buying. You will receive a PDF with instructions to access and download the template.

✅ SUPPORT – Have any questions or need help after your purchase? Send us a message at info@enidkathambi.com, and we’ll respond as soon as possible.

FAQ

Can I Use This Throughout The Year?

Absolutely! You can duplicate the budget dashboard by right-clicking on the tab’s name and picking duplicate. By doing this, you are able to duplicate the budget sheet for use throughout the year. I recommend retaining the original budget dashboard and starting using the duplicate ones. This way, you always have the original as a backup in case you mess up any of the formulas.

Will The Duplicated Budget Tabs Have Auto-Updates For Categories and Actual Amounts?

The category names will appear automatically. The actual transaction figures will also populate automatically once you log them from the Transactions Tracker. However, be sure to change the date of the specific budget sheet you are using to ensure the actual transaction figures reflect in the correct month’s budget tab.

How Can I Use the Calendar For The Whole Year?

The calendar allows you to choose which month to view and the due bills/subscriptions and debts, and the due dates will be fed into the calendar automatically. The data is fed based on what you fill in the second table from your right. The due items will be the same regardless of the month you choose to view. However, if you wish to refer to your month’s calendar history and see what you checked off, it’s important to duplicate the calendar and have one for every month. You can duplicate the calendar tab by right-clicking on the tab’s name and picking duplicate. Then, rename each tab you create to help you identify each month’s calendar tab.

I recommend retaining the original calendar sheet and starting using the duplicate ones. This way, you always have the original as a backup in case you mess up any of the formulas.

Which Debt Payoff Strategy Should I Use?

This Ultimate Monthly Spreadsheet allows you to choose between a Debt Snowball and Debt Avalanche payoff strategy. The best strategy to use will ultimately depend on your current financial situation, how much you want to save in the long run and your feelings about debt.

Well, we talked about debt payoff strategies in this blog post. Here’s a short summary of the two methods;

- The Debt Snowball is an ideal strategy if you are on a budget and want to start feeling the small wins immediately. This strategy focuses on clearing debts with small balances first. It allows you to pay the minimum amounts for all debts and put extra funds into debts with smaller balances. The downward side of this strategy is that you end up paying more in debt if the loans with higher balances also happen to have high-interest rates. Keep in mind that the higher the interest rate and the longer the repayment period, the more expensive the debt is.

- The Debt Avalanche strategy is ideal if you want to save money in the long run. It focuses on repaying debts with high-interest rates first. With it, you pay the minimum payments for all outstanding debts. Then, you put the extra payments into debts with high-interest rates, like digital loans and credit cards.

How Can I Save More Money to Payoff Debt or Increase My Savings?

That’s where the Priority Worksheet comes in handy! It has the Bills and Expenses categories already populated for you. All you have to do is log your actual transactions in the Transactions Tracker, then head over to the Priority Worksheet and choose the priority level of each Bill or Expense. The amounts will be auto-populated based on the actual amounts you logged in the Transactions Tracker. With this, you are able to see how much you spend on each priority level. It will also show you how much you can save if you cut off some items, e.g., any bills/subscriptions and expenses you label as Not Important.

IMPORTANT!

- If you do not see an email with the PDF, please check your Spam folder

- CURRENCY – Uses any currency. Just set up your currency in the Set Up Tab

- USE – This spreadsheet is made specifically for Google Sheets and does not work with Excel

- DOWNLOAD ONLY – The template is a digital download with instant access upon payment. Upon purchase, you will receive a PDF file with a link to access the spreadsheet. No physical product will be shipped.

- REFUNDS – Refunds do not apply to digital downloads with instant access to the product upon purchase. For further information, please refer to our T&C and Shipping & Returns Policy.

- COLOURS – Colours used in the template may vary slightly based on individual devices used due to different colour calibrations on one’s device.

- COPYRIGHT – This planner is for Personal Use Only, not commercial purposes. No part of it can be sold, distributed, reproduced, duplicated, or sold in any form without the written consent of Every Penny Counts Consultancy.

Reviews

There are no reviews yet.