How Many Bank Accounts Do You Need for Your Business

Here’s a question for you, ‘how many bank accounts do you need for your business?’

I have spent the better part of my career in corporate where big organizations have numerous bank accounts. I have also spent a significant part of my career working with small business owners. Not forgetting I’ve been on the whole entrepreneurship journey myself. One of the stark differences is the number of business bank accounts many small business owners opt to have.

Most small business owners will have a single business account. This account handles everything, from review to operating expenses, tax payments, and even savings for a rainy day.

While there is no rule against this, it is really important, as you will see later in the article, to have multiple bank accounts for your small business. But how many should you really have? In this article, I will take you through the benefits of having multiple bank accounts for your business and what accounts you should consider opening—if you don’t have them already.

The Benefits of Having Multiple Business Bank Accounts

Here’s how diversifying your banking setup can support and enhance your business activities:

Related post: Reasons to Separate Personal and Business Finances

Better Cash Optimization

Effective cash flow management is critical in ensuring that your business has the funds necessary to operate smoothly and meet obligations on time. With multiple bank accounts, you can dedicate each account to different aspects of your business finances, such as revenue, expenses, and savings for future projects or emergencies. This setup allows you to allocate resources more effectively, ensuring that funds are available where and when they are needed, without the need to transfer money between different purposes unnecessarily.

Enhanced Organization

Opening multiple bank accounts for your business can help segregate your financial activities into easily manageable segments. For instance, having separate accounts for operating expenses, payroll, and savings can simplify how you track and allocate funds for each activity.

When each account has a specific purpose, monitoring inflows and outflows becomes straightforward, reducing the potential for errors and providing clearer insights into financial performance.

To Reduce Risk

Operating with multiple bank accounts can also reduce financial risk. By distributing your business’s cash reserves across several accounts, you minimize the impact of any fraudulent activity that could occur in a single account.

Additionally, in the unlikely event of bank failures or restrictions on withdrawals, not all your funds will be affected. This spread of resources can act as a safeguard, ensuring that you have access to at least a portion of your funds to keep essential operations running.

Strategic Advantages

When you maintain multiple bank accounts, especially with different banking institutions, you can leverage the benefits that various banks offer. Some banks might offer better interest rates for savings, while others might provide superior transactional capabilities or business loans at more competitive rates.

By diversifying your banking relationships, you have the flexibility to capitalize on the best features from each institution, tailoring your banking experiences to suit your business’s needs.

Simplified Tax Preparation

Having dedicated bank accounts for different financial operations greatly simplifies the process of preparing for taxes. For example, maintaining a separate account specifically for tax liabilities, into which you allocate funds monthly, ensures that you are prepared for tax payments when they are due.

This approach not only helps in better financial planning but also prevents the scrambling for funds at tax time, thus avoiding penalties and stress.

Streamlined Auditing Processes

Multiple bank accounts can make auditing processes more streamlined and efficient. Auditors can quickly verify transactions within each segregated account, reducing the time and effort required to trace and validate financial activities.

This clarity and organization can lead to quicker audit completions and potentially lower auditing costs due to reduced complexity and time requirements.

Don’t miss this related article! 7 Common Banking Terms You Should Know As a Small Business Owner

The Disadvantages of Having Multiple Business Bank Accounts

While having multiple business bank accounts for your small business is advantageous, it’s not without cons. Managing a diversified banking structure can be demanding and might not suit every business. Here’s a detailed look at the challenges you may encounter:

Increased Complexity

Managing several bank accounts adds complexity to your business’s financial operations. Each account requires regular monitoring, maintenance, and reconciliation, which can significantly increase administrative overhead. You may find yourself spending more time managing accounts instead of focusing on core business activities.

This complexity can also lead to confusion if funds need to be transferred frequently between accounts for various expenses, potentially resulting in cash flow issues.

Additional Costs

Each bank account often comes with its own set of fees, such as monthly maintenance charges, transaction fees, and penalties for falling below minimum balance requirements. If you maintain multiple accounts, these costs can accumulate quickly, reducing the overall profitability of your business.

Before choosing the type of bank account to add, ensure that you carefully evaluate the fee structure to ensure that the benefits outweigh the costs.

Risk of Misalignment

Having too many accounts might result in a misalignment between your financial strategy and account structure. For instance, if you set up accounts for specific purposes but fail to use them accordingly, you risk compromising your intended financial management strategy. Misalignment can lead to inefficient cash flow management and complicate the tracking of revenue and expenses.

How Many Bank Accounts Do You Need for Your Business?

There is no one-size-fits-all when it comes to banking news for any business. The number of business banking accounts will vary depending on several factors, including the size of your business and its complexity.

However, at the very minimum, you need at least 3 banking accounts. These are:

- Checking account

- Savings account

- Tax account

- Profit account

Checking Account

We will also refer to this as your operating account. This is the account you need for your business’s day-to-day operations. From receiving money from sales to paying for regular expenses.

This is a basic account that most, if not all, businesses already have. It’s ideal for;

- Receiving income from sales

- Paying operating expenses, e.g., bills

- Making payroll expenses, i.e., salaries

Savings Account

Yes, your business needs a savings account. This is the account where you save funds for a rainy day, i.e. paying for unexpected business expenses such as repairs to equipment or temporary fluctuations in sales.

This account is also a suitable place to set aside funds for future investments in your business. For instance, you might save toward purchasing new equipment, expanding your product offerings, or launching marketing initiatives.

Can’t I just accumulate savings in my business’s current account? Yes, you can do this. However, separating the two accounts ensures you maintain a clear distinction between your business’s operational funds and its financial reserves. In addition, a savings account will earn your business interest income that it’d otherwise not earn in a normal current account.

Tax Account

How stressful is the tax season for you? Do you spend your days stressed about the tax bill coming your way and how you’ll pay? What if I told you it’s possible to look forward to paying your tax bill?

This is where a tax bank account comes in. Think of it as a savings account for your tax bills. Having a separate bank account for tax payments ensures you don’t spend all the money on business operations.

So, how does this work? You can build a tax account by setting aside a certain percentage from every sale to cater to tax expenses. When the tax season comes, you will have built a sizable tax savings account to help you meet any liabilities. For this type of account, I’d recommend opening a savings account rather than a regular checking account.

Profit Account

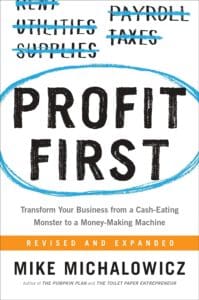

I have been listening to Profit First by Mike Michalowicz whose main theme is for business owners to have a profit regardless of how the business performs. The goal is to ensure you have a profitable business and always get paid.

I have been listening to Profit First by Mike Michalowicz whose main theme is for business owners to have a profit regardless of how the business performs. The goal is to ensure you have a profitable business and always get paid.

In traditional accounting theory and reporting methods, you realize a profit after claiming all the deductible expenses.

Traditional Accounting Method:

Sales – Expenses = Profit

However, in many cases, especially when starting up, businesses will usually have a negative bottom line. In return, business owners waiting for their business to turn profitable to have a fat payday, end up with no payment from the business. Worse, they sink more capital into the business to help it stay afloat.

With a profit account, you can implement the Profit First strategy. Here’s how it works. With every sale your business makes, you take a pre-determined percentage as profit and stash it in your profit bank account. Then, whatever is left, you use it to meet your business expenses.

Profit First Method:

Sales – Profit = Expeses

Besides the above account, you can get an extra account for business, depending on its needs. Other accounts to consider include specialized accounts, like:

- Trust accounts – real estate brokers and attorneys may need to hold client funds in trust accounts separate from operating funds.

- Foreign currency accounts – businesses with international operations may require accounts in different currencies to manage exchange rate fluctuations.

- Escrow accounts – hold funds temporarily during transactions until all conditions are met.

How to Determine the Number of Bank Accounts Your Business Needs

As mentioned earlier, the number of banking accounts to get for your business will depend on several factors, including the size of your business, its complexity, and your goals for growth. Here are some common setups:

Basic Needs

For many small businesses, particularly sole proprietorships and startups, one business checking account and one savings account suffice. This minimal setup helps keep overhead costs low while covering basic transactional needs and savings for future expenses.

Intermediate Setup

As your business grows, its financial needs become more complex, potentially necessitating additional accounts. A typical intermediate setup might include:

- Multiple checking accounts: Separate accounts for operational expenses and payroll can simplify accounting processes and enhance financial management.

- Tax account: Some businesses benefit from having a dedicated account for tax reserves, particularly those with significant quarterly tax payments.

Advanced Needs

Large businesses or those with diverse operations might need several specialized accounts. Considerations include:

- Geographic location – businesses operating in multiple states or countries might need local accounts for easier transactions and compliance with local banking regulations.

- Segmentation – separate accounts for different divisions or product lines can help track profitability and manage budgets more effectively.

How to Choose the Right Bank(s) for Your Business Needs

The right banking partner can make all the difference in your business operations, from easy access to credit to financial advice. As such, it’s important you pay close attention to the banks you choose to work with. Here are the key considerations to keep in mind:

- Fee structure: Look for transparent fee structures with minimal hidden costs.

- Customer service: Choose a bank that offers excellent customer support, ideally with some focus on business accounts.

- Online banking tools: Efficient online tools are crucial for modern businesses to manage their finances effectively.

In Conclusion

The number of bank accounts your business needs ultimately depends on the complexity of your financial operations and your specific business needs. Start with the basics—a single checking and savings account—and scale up as your business grows and requires more sophisticated financial management solutions. Remember, the right banking setup is crucial for the streamlined, efficient operation of your business finances.[/vc_column_text]

DISCLOSURE: THE INFORMATION PROVIDED TO MY READERS IS GENUINE AND PRECISE TO THE BEST OF MY KNOWLEDGE. THE LINKS PROVIDED IN THIS ARTICLE DO NOT BELONG TO ANY AFFILIATE PARTNERS AND I AM NOT PAID FOR THEM. THE ARTICLE OFFERS GENERAL INFORMATION AND SHOULD NOT BE USED AS A SUBSTITUTE FOR PROFESSIONAL ADVICE OR HELP THAT CATERS TO YOUR INDIVIDUAL BUSINESS FINANCIAL NEEDS AND GOALS. KINDLY SEEK HELP AND ADVICE FROM YOUR CERTIFIED ACCOUNTANT OR TAX PROFESSIONAL. ANY ACTION TAKEN BASED ON THIS INFORMATION IS AT YOUR OWN RESPONSIBILITY AND RISK.

FAQ

Should I have a separate bank account for my business if I’m a sole proprietor?

Yes, even if you’re a sole proprietor, it’s important to keep your personal and business finances separate. A dedicated business bank account simplifies bookkeeping, ensures clearer financial reporting, and helps establish your business’s credibility. It’s also essential for tax purposes, making it easier to track business expenses and income, which can be crucial during tax filing or an audit.

Should I have a business savings account even if my business is small?

Yes, a business savings account is beneficial for businesses of all sizes. It allows you to set aside funds for emergencies, future investments, or unexpected expenses while earning interest. Even small contributions can accumulate over time, helping you build a financial safety net for your business.

What are the key factors to consider when choosing a bank for business accounts?

When choosing a bank, consider factors like fee structures, account features, customer service, online banking tools, and lending options.