Is my money safe in a Money Market Fund?

Here’s a question I’ve received lately, “Is my money safe in a money market fund (MMF)?” This was after one of the money market funds posted their financials showing it made a loss. Would you be worried too if you had your money in that money market fund?

I have talked in detail about MMFs, including some of the funds to consider and how to choose an MMF. But how do they really work? Is your money safe? What would happen to your money if the firm is making losses? Or if it were to liquidate? That’s why I am here. To get you answers to these questions and more!

What is a Money Market Fund (MMF)?

An MMF is a type of unit trust, i.e. an investment vehicle that invests funds pooled from numerous investors. The difference between an MMF and other unit trusts, like a fixed income fund or a balanced fund, is that it focuses solely on short-term and very liquid investment assets, like treasury bills.

MMFs have become quite popular, thanks in part to their affordability, liquidity, and higher returns than traditional savings accounts. But is your money safe in a MMF?

@enidkathambi Replying to @challo Here’s quick guide of how you can search and choose a MMF to save in. #moneymarketfund #moneymarketfundinkenya #personalfinance #personalfinancetips ♬ original sound – FA Enid

How Money Market Funds Work

When we talk about how MMFs work we mostly focus on the type of assets fund managers invest, liquidity, and management fees. Mostly, we focus on the underlying assets, T-Bills, commercial papers, and other cash & equivalents, which make MMFs conservative and low-risk investment avenues.

But, how about the inner workings or management of the fund that helps ensure your money is safe?

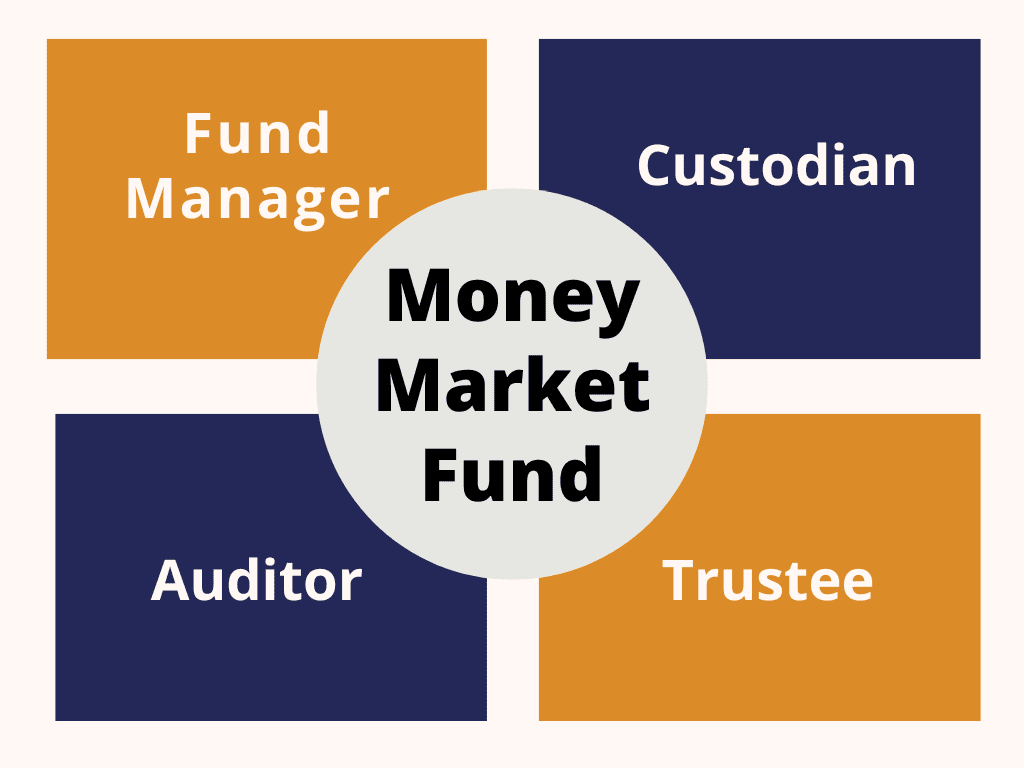

While no investment avenue is risk-free, unit trusts, including money market funds, have designed an eco-system that helps reduce the risks of losing investors’ funds. This eco-system includes four main parties;

- The fund manager

- The custodian

- The trustee, and

- The auditor

When looking for an MMF to join, ensure that you also consider the service providers acting as the custodian, trustee, and auditors of the fund. These details are usually available on the fund’s Fact Sheet.

Let’s look at the roles of these parties in more detail.

The Fund Manager

The Fund Manager is primarily responsible for the day-to-day management of the fund’s portfolio. This includes deciding on the specific securities to buy or sell within the parameters set out in the fund’s prospectus.

The Fund Manager’s goal is to maintain the fund’s stability and liquidity while seeking to achieve optimal returns. They analyze market conditions and make investment decisions that align with the fund’s objectives and risk tolerance.

The Custodian

The Custodian, typically a bank, holds the securities owned by the fund in safekeeping. Their role is crucial in preventing misappropriation of assets. The Custodian ensures that all holdings are properly accounted for and that transactions are executed as instructed by the Fund Manager and in line with the fund policy.

Additionally, the Custodian handles the settlement of all buying and selling of securities, maintaining an additional layer of oversight against the mismanagement of fund assets.

The Trustee

The Trustee acts as the protector of the investors’ interests. This party is legally obligated to ensure that the MMF is managed in accordance with its trust deed and the regulatory requirements set forth by authorities like the Capital Markets Authority.

The Trustee monitors the actions of the Fund Manager and the Custodian, ensuring compliance with the law and ethical investment practices. They are tasked with ensuring that all parties involved act in the best interests of the investors.

The Auditor

Finally, the Auditor provides an independent assessment of the MMF’s financial statements and operations. Their audits help ensure that the fund is accurately reporting its financial position and that it adheres to accounting standards and regulatory requirements.

The Auditor’s scrutiny aids in maintaining transparency and trust, as their findings are often reported to the investors and regulatory bodies, thus providing external verification of the fund’s health and management practices.

Don’t miss this related post! 6 Easy Tips on How to Choose an Investment Company

The Role of Capital Market Authority (CMA)

Unfortunately, MMFs do not offer explicit government guarantees on your money. This means that the government doesn’t directly insure your invested capital, unlike some deposit accounts where funds are guaranteed by the Kenya Deposit Insurance Corporation (KDIC). For instance, if your bank were to collapse, KDIC provides deposit coverage of up to KSh. 500,000 per depositor. However, funds in MMFs do not enjoy the same deposit coverage.

Having said that, MMFs in Kenya operate within a regulatory framework overseen by the Capital Markets Authority (CMA). The CMA plays a vital role in safeguarding investor interests. It establishes and enforces regulations for investment firms and funds, including MMFs, ensuring they operate transparently and adhere to strict investment guidelines.

While there’s no direct government guarantee, the CMA’s regulatory framework provides an added layer of security. That’s why it’s important to ensure that the MMF you choose to save or invest with is regulated by CMA.

What Happens if the Firm Holding the Money Market Fund Collapses?

Now, back to the question I was asked, is your money safe if the firm operating the MMFs reports losses? Or worse, if it liquidates?

Even a scenario where the investment firm managing your MMF faces financial difficulties doesn’t necessarily mean your invested capital is lost. Here’s why:

Custodian Banks

MMFs are required to utilize a custodian bank. This is a separate, independent financial institution responsible for safekeeping the fund’s assets. The custodian bank holds the securities on behalf of the investors, entirely separate from the assets of the investment firm itself.

Security of Underlying Assets

This segregation ensures that even if the investment firm encounters financial problems, the underlying securities held by the MMF remain secure. They continue to be held by the custodian bank and are not affected by the investment firm’s situation.

In such an instance, the custodian bank, along with the CMA, would work towards ensuring an orderly transition of the MMF’s operations to a new investment firm. While there could be some administrative delays, your ownership of the underlying securities remains intact.

Final Word

There is no denying that MMFs are one of the best ways to save and invest your money. They are affordable, where you can start with as low as KSh. 500 to KSh. 1,000. They are also very liquid with the ability to withdraw your funds within 48 to 72 hours. Some funds will even process funds within 24 hours as long as your withdrawal meets their limit. Additionally, they are low-risk and offer diversification given the underlying assets they invest in. Most importantly, the returns are quite attractive.

However, keep in mind that MMFs are not entirely risk-free. Credit risk, interest rate risk, and even rare liquidity issues can potentially impact your investment. Additionally, while the regulatory framework overseen by the CMA offers a layer of security, there’s no explicit government guarantee on your principal investment. If anything were to happen to the firm, there is no guarantee of a refund of your money from the KDIC.

The key takeaway is to approach MMFs with a clear understanding of benefits and risks. Carefully consider your risk tolerance and investment goals before deciding if MMFs align with your financial strategy. Don’t forget to look at the firm’s history and the fund’s Fact Sheet for details of its service providers, i.e., the Custodian, Trustee, and Auditor. These will give you an idea of the team behind the management of your money.

Anthony Kiambati

Amazing article.

Enid Kathambi

Thank you, Anthony. Happy to hear the article has been helpful.