How to Read a Cash Flow Statement For Your Small Business

Do you know how to read a cash flow statement for your small business? Unfortunately, many small business owners focus on the bottom line, i.e., the last line item on their profit and loss statement (P&L), also known as the income statement. But as we say, cash is king. That’s where the cash flow statement comes in handy.

A cash flow statement focuses on the actual movement of cash in and out of your business. Regardless of the bottom line, you want to be able to know how much your business is bringing and how much you are spending in actual figures.

Unlike the P&L, which shows profits on an accrual basis, the cash flow statement reveals how much cash is truly available to fund operations, pay debts, and invest in growth. This distinction is very important, as it can influence your business decisions and strategy.

In this article, I will take you through the basics of a cash flow statement, including its components and how you can interpret the data to help you make better-informed and strategic decisions for your small business.

What is a Cash Flow Statement

A cash flow statement is one of the 3 key financial statements. It mainly focuses on the actual money coming in and out of the business. A cash flow statement is important because it helps you;

Check out these 7 Easy Cash Flow Management Tips for Small Businesses

Understand the Liquidity of Your Business

A cash flow statement is the best financial statement to offer you a clear snapshot of your business’s liquidity. This refers to your business’s ability to meet its financial obligations.

Why is this important? Because the immediate availability of cash ensures operational stability and solvency, regardless of your business’s profitability on paper.

Understand How Cash Moves in the Business

A cash flow statement is made up of three sections, operating, investing, and financing activities. This allows you to see the specific areas where your business generates cash and where it spends.

Understanding each segment will help you make informed decisions, such as;

- Whether your core operations are generating sufficient cash

- If you’re investing in assets that could contribute to long-term success, or

- How your financing decisions affect your cash position

The 3 Components of a Cash Flow Statement

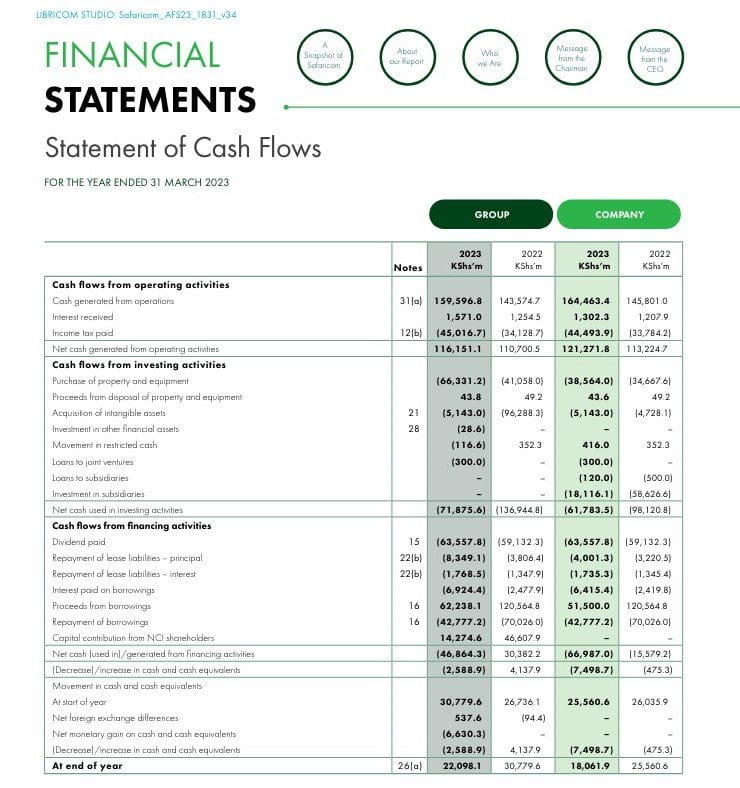

As mentioned, a cash flow statement has 3 sections, operating activities, investing activities, and financing activities. Each of these sections represents a different type of cash activity in your business.

It’s important that you understand the basics of these sections. The information you get here is crucial for accurately interpreting how your business operations, investments, and financing activities affect your cash position. Here’s what each part entails and why it matters to you:

Cash From Operating Activities (CFO)

This section focuses on the cash generated and used in your day-to-day business operations. In other words, it tracks the cash that comes from selling your products or services (inflows) and the cash you spend to keep the business running (outflows).

This includes things like customer payments, inventory purchases, rent, employee salaries, and other operating expenses. It’s important to note that non-cash expenses, like depreciation, might be included here with an adjustment to reflect their impact on cash flow.

A healthy CFO section indicates your business is generating enough cash from its core activities to cover its ongoing expenses. This allows you to reinvest in growth, manage debt, and build a financial buffer for unexpected situations.

Related read: Accrual Accounting vs Cash Accounting: Which Is Best For Your Small Business

Cash From Investing Activities (CFI)

Under this section, you will see cash your business has spent on and received from long-term assets like property, plant, and equipment—assets that are vital for future growth but do not contribute to immediate cash inflows. This section also includes cash spent on investments in other businesses and proceeds from the sale of these investments.

For instance, if you purchase new equipment for your business, that cash outflow would be reflected here. Conversely, if you sell a company vehicle, the cash inflow would be recorded in the CFI section.

A significant outflow in this section might indicate your business is investing in future growth, while a large inflow could suggest the sale of assets to free up cash. However, consistent negative cash flow here should be carefully monitored to ensure long-term sustainability.

Cash From Financing Activities (CFF)

This section focuses on how your business raises and repays financing. This includes cash from issuing shares or bonds, borrowing from banks, and repaying bank loans, along with paying out dividends to shareholders.

Cash from financing activities helps you understand how your business finances its growth and how it returns value to shareholders. It can also show if your business is servicing its debt effectively, which is crucial for maintaining good relationships with creditors and ensuring financial stability.

A high level of cash inflows in this section might indicate your business is actively seeking external funding for growth, while significant outflows could suggest you’re paying down debt or distributing profits to shareholders.

How to Interpret Your Business’s Cash Flow Statement

Once you’ve familiarized yourself with the three main sections of a cash flow statement (CFO, CFI, and CFF), it’s time to bring it all together. The key to interpreting your cash flow statement lies in understanding the net cash flow.

Net Cash Flow

This is calculated by summing the cash flows from each section (CFO + CFI + CFF).

Net Cash Flow = Cash From Operating Activities + Cash From Investing Activities + Cash From Financing Activities

A positive net cash flow indicates your business generated more cash than it used during the period covered by the statement. This is a healthy sign, as it suggests your business has sufficient cash to cover its obligations, invest in growth, and weather unexpected financial bumps.

Negative Net Cash Flow

A negative net cash flow means your business used more cash than it generated during the period. This doesn’t necessarily signal trouble, especially for young businesses that are investing heavily in growth.

However, a persistently negative net cash flow over an extended period could indicate a need to improve cash collection strategies, secure additional funding, or adjust your spending habits.

The Link Between Profitability and Cash Flow

If you have come so far, you already understand that profitability (net income) and cash flow are not synonymous. You can have a profitable business as per your income statement but still encounter cash flow challenges. Here’s why:

Accrual vs. Cash Basis

Profitability often includes earnings not yet received in cash form, such as credit sales. Conversely, cash flow focuses solely on actual cash transactions, providing a clearer picture of your financial health in real time.

Related read: Understanding Profits vs Cash Flow For Your Small Business

Non-Cash Expenses

Items like depreciation and amortization affect profits but do not impact your cash reserves. Therefore, your business might appear less profitable after these deductions, yet your cash position could be strong.

Capital Expenditures and Debt Payments

These necessary outlays can drain cash but are generally not reflected in the profitability calculations. They need to be funded from operational cash flow or external financing.

How to Use a Cash Flow Statement for Business Decisions

So far, you can read and interpret the data on your business’s cash flow statement. So, how can you use this information to make business decisions? Here’s how:

Determining Short-Term Financial Health

The CFO section of the cash flow statement is an excellent guide to whether you’re generating enough cash to cover your ongoing expenses, like rent and payroll. This awareness empowers you to make informed decisions about managing your cash reserves and avoiding potential shortfalls.

Budgeting and Financial Planning

Cash flow statements are an excellent guide for creating realistic budgets and financial plans. A clear understanding of historical cash inflows and outflows allows you to make more accurate projections for future periods. This allows you to plan for upcoming expenses, like equipment purchases or marketing campaigns, with a clear understanding of your cash flow capacity.

Investment Decisions

Your business’s cash flow statement is an invaluable resource for evaluating potential investments in long-term assets. Analyzing the CFI section can help you assess the impact of the investment on your cash flow. This allows you to make informed choices about how to finance these investments and ensure they don’t strain your cash reserves.

Debt Management

If your business relies on loans or lines of credit, your cash flow statement is crucial for managing that debt effectively. By analyzing the CFF section, you can assess your ability to make future loan repayments and avoid potential defaults.

Common Mistakes to Avoid

Are you ready to start looking at and interpreting your business’s cash flow statements? It’s important that you be aware of common pitfalls that can skew your understanding of the business’s financial health. Avoiding these mistakes will help you make more accurate assessments and informed decisions.

Ignoring Regular Review

One of the most frequent mistakes is not reviewing the cash flow statement regularly. This document is a dynamic reflection of your business’s financial status and should be checked consistently to catch and address issues before they escalate. Neglecting this can lead to missed opportunities for improvement or delayed responses to cash flow problems.

Confusing Profit with Cash Flow

It’s important not to confuse net income (profit) with cash flow. While both metrics are essential for evaluating your business’s performance, they serve different purposes and are calculated differently.

Profit includes non-cash items like depreciation and may include revenues earned but not yet received. In contrast, the cash flow statement focuses solely on actual cash transactions, providing a clearer picture of your liquidity.

Overlooking the Impact of Working Capital

Failing to consider changes in working capital can lead to misunderstandings about cash flow. Increases in inventory or accounts receivable might not immediately impact your profit but will tie up cash, potentially leading to cash flow shortages even as your income statement shows a profit.

Neglecting the Context of Numbers

Merely looking at the numbers without understanding their context can lead to poor decision-making. It’s important to know why certain cash flows have occurred.

For example, a significant cash inflow from financing activities might solve short-term liquidity issues but could lead to higher debt levels, impacting long-term financial stability.

Underestimating the Importance of Cash Flow Forecasting

Lastly, not engaging in cash flow forecasting is a significant oversight. Forecasting helps you anticipate future cash flows based on estimated cash inflows and outflows over a specified period.

This proactive approach allows you to manage cash more effectively, plan for investments, and ensure you have sufficient funds to cover upcoming obligations.

However, keep in mind that it’s challenging to predict accurately cash inflows and outflows. As such, forecasting is just a guide for better decision-making.

FAQ

Where can I find my cash flow statement?

Your cash flow statement is typically included in your business’s financial statements, which might be prepared by your accountant or bookkeeper. If you use accounting software, it might also generate cash flow reports.

How often should I review my cash flow statement?

It is advisable to review your cash flow statement at least quarterly. However, if your business operates in an industry with rapid changes or tight cash margins, monthly reviews may be necessary. Regular reviews help you stay on top of your business’s financial status and enable proactive management of your cash flows.

My cash flow statement shows a negative net cash flow. Should I be worried?

Not necessarily. A negative net cash flow can occur for various reasons, especially for young businesses investing in growth. However, a persistently negative net cash flow over an extended period might warrant a closer look at your cash collection strategies, spending habits, or the need for additional funding.

How can I improve my cash flow?

Improving cash flow involves managing both the timing and amount of cash inflows and outflows. Common strategies include speeding up receivables, extending payables without accruing penalties, optimizing inventory levels, and making prudent spending decisions.

Is a cash flow statement the same as a profit and loss statement?

No, although they are both important financial statements. A profit and loss statement (income statement) focuses on your business’s profitability over a specific period. It shows your revenue, expenses, and net income. A cash flow statement, on the other hand, tracks the actual movement of cash in and out of your business.