2024 Financial Planning With the EPC Budget Planner Book

Ihave been accused severally of overthinking, especially when it comes to significant financial plans. From starting a project or a business to making major purchases. My brain spirals out of control as I try to make everything look and go perfectly — theoretically. It’s the planning process that agonises me the most. I know things can go wrong even with the best-laid plans. But the planning bit, that’s where I tend to spend my sweet time and drive myself crazy.

I do have a budgeting and financial planning system in Google Sheets. It has made it easier for me to track my earnings, savings, investments and overall financial position. I might not be good at tracking every cent, but I am always happy knowing the budgeting system I chose to use, Pay Yourself First, is working perfectly.

However, my financial planning document has additional sheets where I enter all my rumblings and numerous research and store links of things I want to purchase. So, when my brain is spiralling out of control, and my computer is running 5 to 6 chrome windows, each with 10+ open tabs, my anxiety starts to kick in because the dream I am chasing suddenly seems unattainable.

Worse, I am such a lazy bum. So much so that I do most of my personal finance accounting on the last or first week of the month. I just need to set aside at least 2 hours during this period, distribute my money in various savings and investment accounts, capture that data in the budgeting spreadsheet, and it’s bye-bye until the following month. And since I save and invest first so I can use whatever is left guilt-free, I end up piling up shopping receipts for reviewing later.

David Rose from Schitt’s Creek describes me

I would like a more streamlined process for the coming year. I have bigger projects in mind, so I need my brain to focus more and not wander around. My household expenses have been manageable, although I feel I can do better, especially with expenses for the little rascals, aka my pets. I also want a financial planning system where I don’t always have to stare at a screen.

So, I have decided to use a budgeting planner book in tandem with my spreadsheet to make my thinking and planning process more effortless in the coming year.

Are you ready to set financial goals for the coming year? Here is a guide

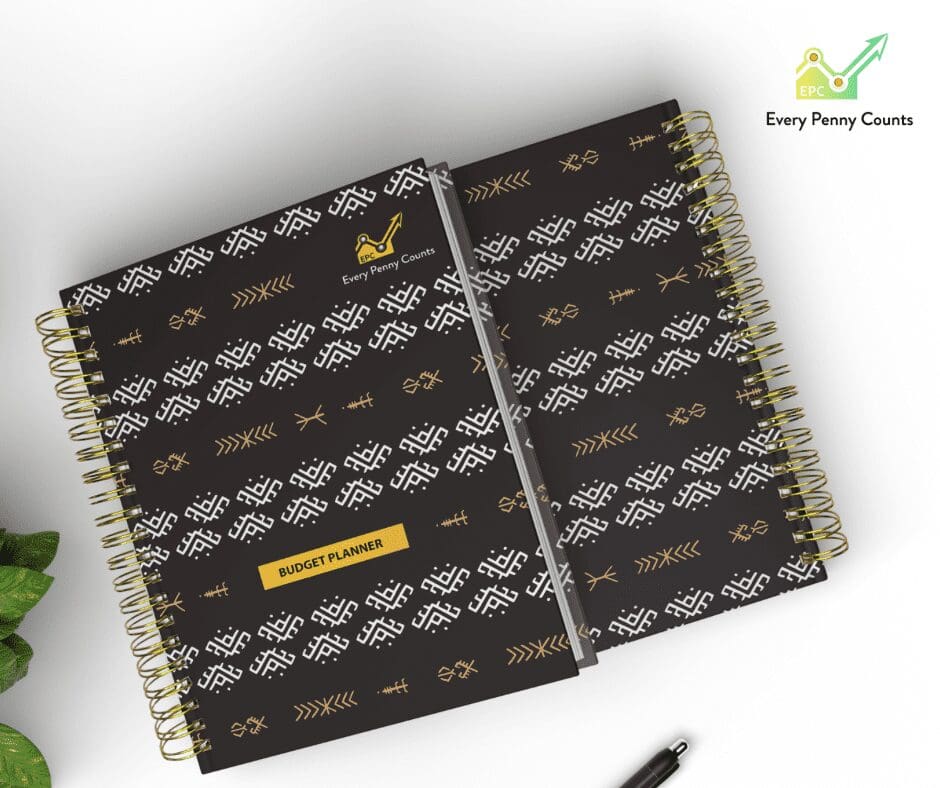

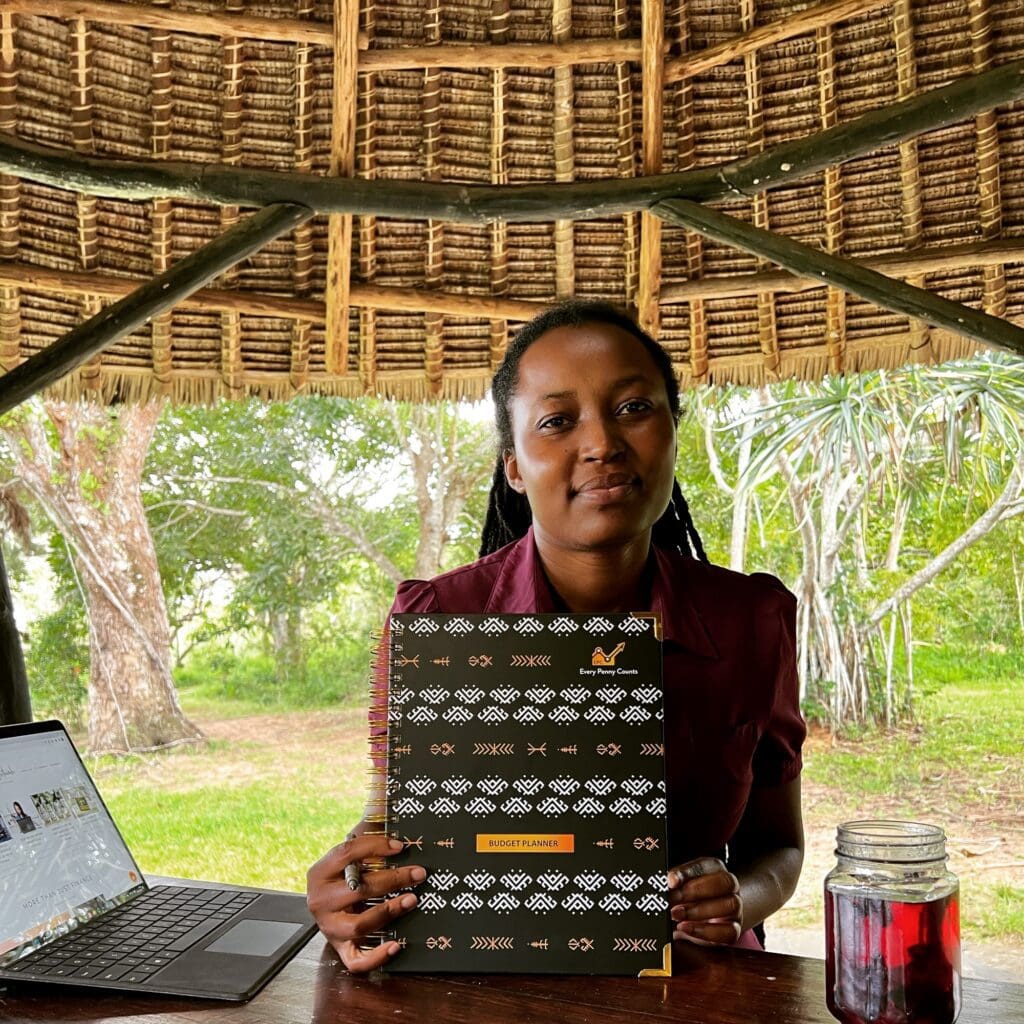

Financial Planning Using the EPC Budget Planner Book

Don’t get me wrong. The spreadsheet is good. With all the interlinked formulas, I have less work. But as I have mentioned, I want a manageable planning system that doesn’t allow my brain to spiral out of control anytime I open a budgeting spreadsheet.

So I learned Indesign and designed a budgeting planner that suited my needs. What does this budgeting planner book get you? Below are some of its important features;

- Start at any time – the planner is undated, allowing you to start at any time, regardless of the day or the year.

- Financial goals section – helps with planning your money because every decision and transaction you make has a purpose.

- Money affirmations – we can all use a pat on the back, right? Writing down your money affirmations is a very powerful method of staying motivated and working toward your financial success regardless of what comes your way.

- Expense tracker – the expense tracker in this planner allows you to track how much goes into each expense and specific categories on a monthly and yearly basis. Even if you use the Pay Yourself First budgeting style, it is good to have a rough idea of how much each expense category takes.

- Savings and investments tracker – saving and investing are essential in protecting your finances and growing wealth. It is even better to track savings for each goal you have. The savings trackers in this book give you just that.

- Debt tracker – without proper debt management, you will remain in an unstable financial situation forever. A debt tracker helps you see where you are, allowing you to develop a repayment plan to get out of debt faster.

- Net worth – do you know your financial position? Knowing your net worth helps you see whether your assets are more than your liabilities. If not, you can identify what liabilities are driving your net worth to the negative side.

- Pockets – remember how I pointed out earlier that I pile up receipts on my desk? I knew I needed a safe place to keep receipts while designing this planner. More importantly, I needed better organisation, like a month-to-month system. To meet this need, the planner comes with 12 pockets.

- Spacious – you have enough space to write on — especially if you have atrocious handwriting like yours truly

The EPC Budget Planner Book is available here, with FREE DELIVERY across Kenya.

What’s Your Budgeting Method?

I have discussed severally available budgeting methods. Given our unique personalities and experiences with money, you will find one or more of these budgeting methods to be more in sync than the other. That’s why it doesn’t hurt to try a few or all of them before finally settling on the one that suits you.

Regardless of your chosen budgeting method, this planner will enable you to manage your money and make Every Penny Count (pun totally intended!)

Shop more financial planning tools here